Introduction

Investing is no longer just for the wealthy — it’s for everyone who dreams of financial independence. But one question continues to puzzle most investors:

👉 Should you invest through SIP (Systematic Investment Plan) or go for a Lump Sum investment?

Both methods aim for wealth creation but differ in timing, risk exposure, and emotional comfort. Choosing the right one depends on your income, market outlook, and financial goals.

In this detailed guide, let’s decode the pros, cons, and ideal scenarios of SIP vs Lump Sum so you can make an informed decision — whether you’re investing in mutual funds, stocks, or ETFs.

1. Understanding SIP and Lump Sum Investments

What Is SIP (Systematic Investment Plan)?

A SIP is a disciplined way of investing a fixed amount at regular intervals (monthly, quarterly, etc.) in a mutual fund or stock.

It’s like putting your investment on autopilot — you invest consistently, irrespective of market conditions.

💡 Example:

If you invest ₹10,000 every month for 10 years in an equity mutual fund generating 12% returns, your corpus becomes ₹23 lakh, even though you’ve invested only ₹12 lakh.

Key Features of SIP:

- Automated regular investments

- Benefits from market volatility (rupee cost averaging)

- Promotes financial discipline

- Ideal for salaried or regular-income individuals

What Is Lump Sum Investment?

A lump sum means investing your entire amount at once — say, ₹5 lakh in a single go.

It’s a one-time investment strategy, suitable when you have a large idle fund (like bonuses, inheritance, or business profits).

💡 Example:

If you invest ₹5 lakh at once in a mutual fund that grows at 12% per year for 10 years, your investment grows to ₹15.5 lakh.

Key Features of Lump Sum:

- One-time capital deployment

- Ideal during bullish markets or market dips

- Requires market timing and confidence

- Suitable for investors with high risk appetite

2. SIP vs Lump Sum — Key Differences at a Glance

| Feature | SIP | Lump Sum |

|---|---|---|

| Investment Type | Regular monthly/periodic | One-time |

| Market Timing Risk | Lower | High |

| Average Cost Benefit | Yes (Rupee Cost Averaging) | No |

| Volatility Impact | Minimized | Higher |

| Ideal For | Salaried individuals | Investors with idle large funds |

| Financial Discipline | High | Low |

| Return Potential (long-term) | Stable, compounded | Can outperform if timed perfectly |

3. SIP: The Power of Consistency and Compounding

SIP is often called the “lazy investor’s best friend” — simple, automatic, and effective.

It builds wealth steadily by using two powerful principles:

a) Rupee Cost Averaging

In SIPs, you buy more units when the market is low and fewer when it’s high — averaging your purchase cost over time.

This protects you from short-term volatility.

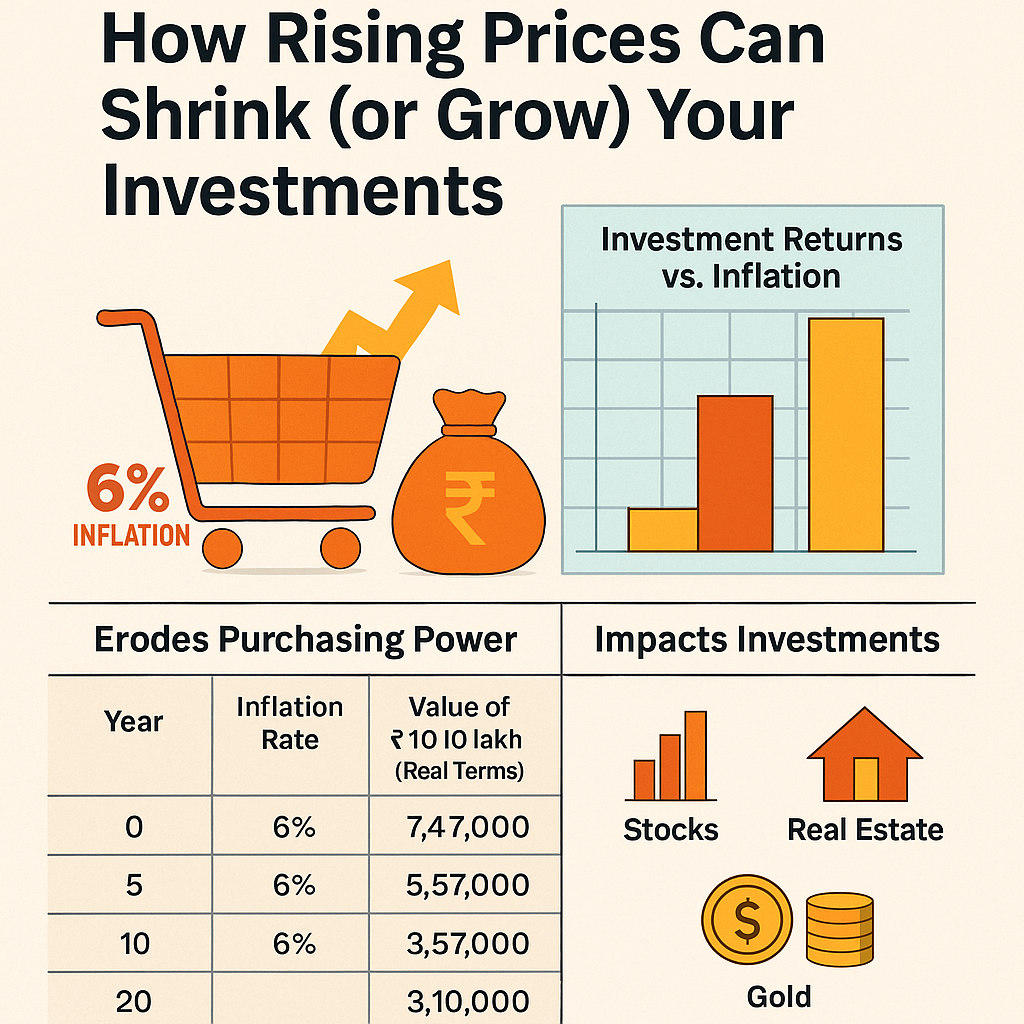

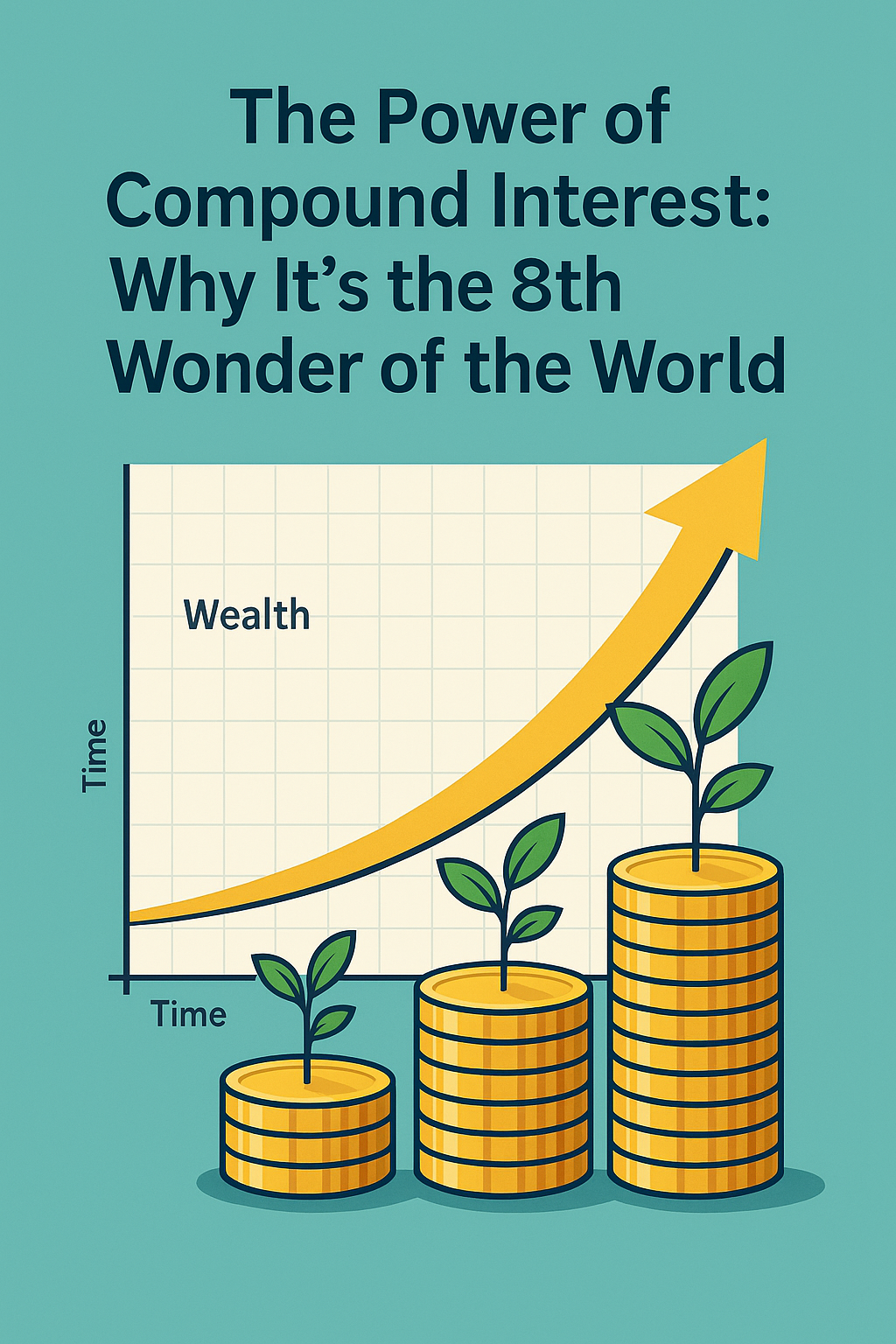

b) Power of Compounding

Since SIPs are consistent, every invested rupee starts earning returns — and those returns earn more returns.

That’s how small, regular investments snowball into massive wealth over time.

📊 Example:

₹10,000 per month SIP for 20 years at 12% CAGR = ₹98 lakh corpus (₹24 lakh invested only).

That’s the magic of compounding.

Advantages of SIP

✅ No need to time the market

✅ Smoothens out volatility

✅ Perfect for long-term financial goals (retirement, children’s education)

✅ Low emotional stress

✅ Encourages financial discipline

Disadvantages of SIP

❌ Slower initial growth (since capital builds gradually)

❌ May miss short-term rallies if markets rise sharply

❌ Returns depend on consistent investing

4. Lump Sum: The Power of Timing and Conviction

Lump sum investing can give superior returns — if timed correctly.

When markets are undervalued or after a correction, investing a lump sum can yield exponential growth because your entire capital starts compounding immediately.

📊 Example:

₹5 lakh invested at once in 2014 in Nifty 50 (10-year CAGR ~13%) would be worth nearly ₹17 lakh in 2024.

That’s the advantage of having your money work harder, earlier.

Advantages of Lump Sum

✅ Immediate exposure to full growth potential

✅ Best suited when markets are undervalued

✅ Simple — one-time decision

✅ Higher potential returns in bull markets

Disadvantages of Lump Sum

❌ May lead to heavy losses if invested during market peaks

❌ Requires market timing skill

❌ Can cause emotional stress during volatility

❌ Not suitable for beginners

5. SIP vs Lump Sum — Which Performs Better?

Let’s compare with an example 👇

| Investment Type | Total Invested | Duration | Avg Return | Final Corpus |

|---|---|---|---|---|

| SIP (₹10,000/month) | ₹6,00,000 | 5 years | 12% | ₹8.13 lakh |

| Lump Sum (₹6,00,000) | ₹6,00,000 | 5 years | 12% | ₹10.58 lakh |

So yes — lump sum may deliver higher returns if markets rise continuously.

But in real-world investing, markets fluctuate — that’s where SIP wins with stability and lower risk.

💡 Historical data (from AMFI India) shows that SIPs outperform lump sums in 70% of 5-year rolling periods because they handle volatility better.

6. When to Choose SIP Over Lump Sum

Choose SIP when:

- You’re a salaried or regular-income earner.

- You want to avoid timing the market.

- Your goal is long-term (5–10+ years).

- You’re investing for retirement, home, or children’s education.

- You prefer disciplined investing over speculation.

SIP suits those who value consistency over chance — it makes market volatility your ally.

7. When to Choose Lump Sum Over SIP

Choose Lump Sum when:

- You’ve received a large one-time fund (bonus, sale, inheritance).

- You can analyze market trends or consult an advisor.

- Markets are undervalued (post-correction or bearish phase).

- You want aggressive long-term growth.

💡 Smart Tip:

Instead of investing your entire lump sum at once, divide it into 3–4 tranches and invest over 3–6 months — this reduces timing risk.

8. Best of Both Worlds: SIP + Lump Sum Hybrid Approach

Why choose one when you can combine both?

How to Do It:

- Keep a monthly SIP running for long-term goals.

- When markets correct or dip significantly, invest an additional lump sum.

This hybrid approach helps you:

✅ Capture opportunities during market dips

✅ Maintain consistent growth

✅ Build wealth faster

📈 Example:

If you do a ₹10,000/month SIP + ₹1 lakh lump sum every time the market corrects by 10%, your portfolio grows faster while balancing risk.

9. SIP and Lump Sum in Mutual Funds

Both strategies are most commonly used in mutual funds, especially equity funds, hybrid funds, and ELSS.

- SIP Mutual Funds: Ideal for young investors starting small.

- Lump Sum Mutual Funds: Better for experienced investors with market knowledge.

Popular Mutual Fund Categories for SIPs:

- Flexi Cap Funds

- Large Cap Equity Funds

- Index Funds

- ELSS (Tax-saving funds)

Best Funds for Lump Sum:

- Balanced Advantage Funds

- Multi Cap Funds

- Blue-Chip Equity Funds

10. Tax Impact: SIP vs Lump Sum

Tax treatment is identical for both SIP and Lump Sum investments — it depends on holding period and fund type.

| Investment Type | Short-Term Capital Gains (STCG) | Long-Term Capital Gains (LTCG) |

|---|---|---|

| Equity Funds | < 1 year → 15% | > 1 year → 10% (above ₹1 lakh) |

| Debt Funds | As per tax slab | As per tax slab |

Note: In SIPs, each installment is treated as a separate investment for tax purposes.

11. Real-Life Example

Let’s take two investors — Rohit and Meera.

- Rohit invested ₹6 lakh lump sum in Jan 2020 (just before COVID crash).

- Meera invested ₹10,000/month SIP starting the same time.

When the market crashed in March 2020:

- Rohit’s portfolio dropped 35%.

- Meera’s SIP benefited — she bought more units cheap during dips.

By 2025:

- Meera’s SIP portfolio grew steadily with lesser emotional stress.

- Rohit recovered too, but it took longer — and required more patience.

Moral: SIP gives peace of mind and smoother returns for average investors.

12. Final Verdict — Which Is Better?

There’s no universal winner — the right choice depends on your financial profile and market condition.

| Profile | Best Choice | Why |

|---|---|---|

| Salaried professional | SIP | Regular income + volatility management |

| Experienced investor | Lump Sum | Can time markets better |

| Conservative investor | SIP | Safer and disciplined |

| High-risk taker | Lump Sum | High reward potential |

| Long-term wealth builder | Both | Balance risk and return |

Simple Rule of Thumb:

- If in doubt → Go SIP

- If confident → Go Lump Sum

- If smart → Combine both!

Conclusion: Invest with Time, Not Timing

In the end, both SIP and lump sum are paths to the same goal — financial freedom.

The difference lies in how comfortable you are with risk and how disciplined you are with money.

Markets will always fluctuate, but time in the market beats timing the market.

So start today — whether through a ₹1,000 SIP or a ₹5 lakh lump sum — because the earlier you start, the more time your money gets to grow.

“It’s not about timing the market; it’s about time in the market.”

Leave a Reply