Introduction

Think investing is only for the rich? Think again.

With as little as ₹500 per month, you can start your journey toward financial independence through a Systematic Investment Plan (SIP).

Whether you’re a student, young professional, or small business owner, SIPs make wealth creation affordable, flexible, and achievable for everyone.

In this article, we’ll break down how to start a SIP with ₹500, the steps involved, the best mutual funds to consider, and how small, consistent investments can create massive long-term wealth — even if you’re just starting out.

1. What Is a SIP (Systematic Investment Plan)?

A Systematic Investment Plan, or SIP, is a simple method of investing small amounts regularly (usually monthly) into a mutual fund.

Instead of putting in a large amount at once, you invest a fixed sum — say ₹500, ₹1,000, or ₹2,000 — every month, no matter how the market is performing.

Over time, SIPs help you:

- Accumulate wealth through discipline

- Benefit from rupee cost averaging

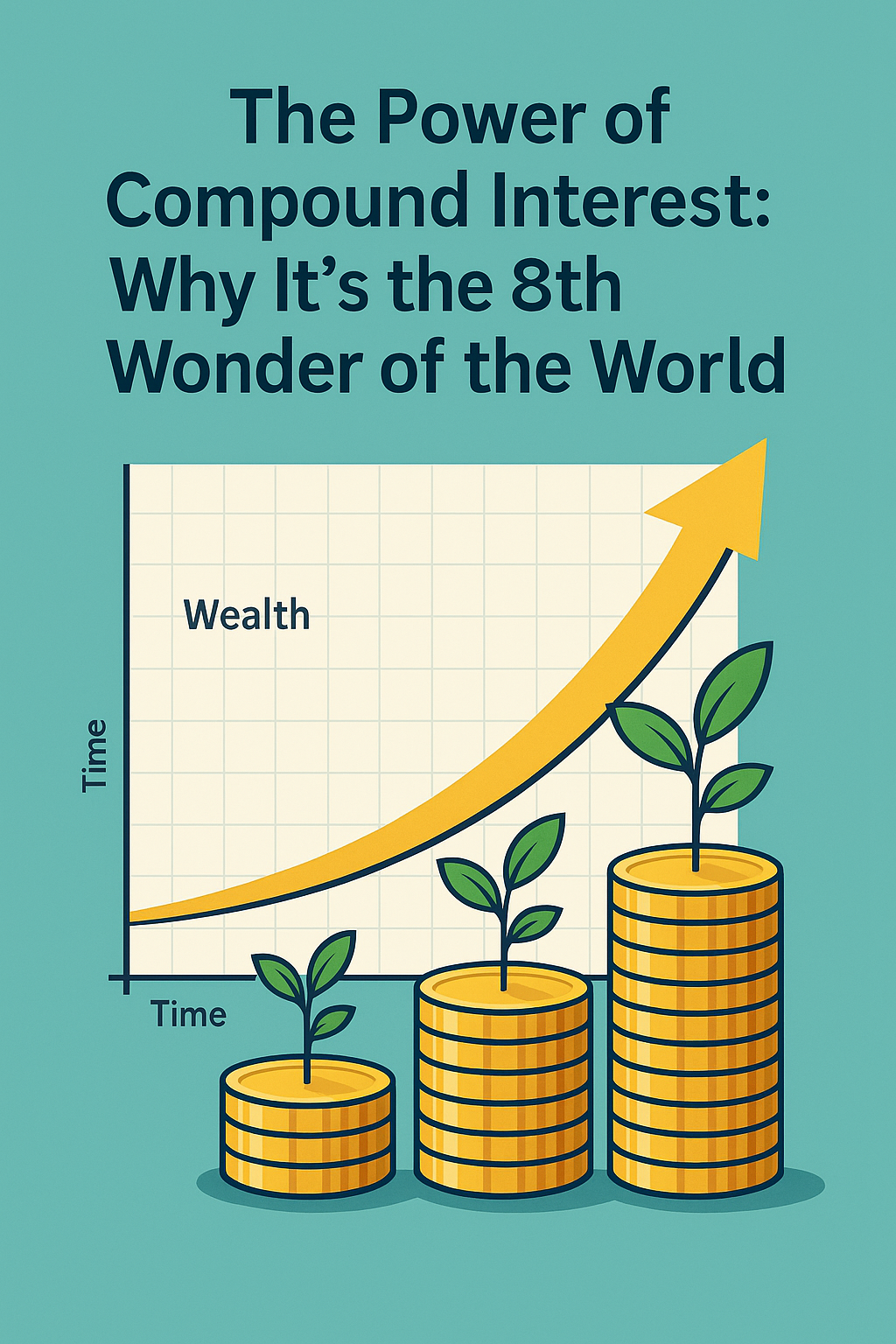

- Harness the power of compounding

💡 In short: SIP = Regular investing + Time + Patience = Wealth creation.

2. Can You Really Start a SIP with ₹500?

Yes, absolutely ✅

Most Indian mutual funds allow you to start a SIP with as little as ₹500 per month.

That’s less than the cost of:

- 2 coffees at Starbucks ☕

- 1 meal at a restaurant 🍽️

- or a weekend movie ticket 🎬

And yet, this tiny amount — invested consistently — can grow into lakhs over time.

📊 Example:

If you invest ₹500/month for 20 years with 12% annual returns (common in equity mutual funds):

Your total investment = ₹1.2 lakh

Final corpus = ₹4.96 lakh

That’s over 4X growth, just by staying consistent.

3. Why You Should Start a SIP Early

Starting small isn’t a problem — starting late is.

When you begin early, time and compounding do most of the heavy lifting.

| Start Age | Monthly SIP | Duration | Final Amount (12% CAGR) |

|---|---|---|---|

| 20 years | ₹500 | 30 years | ₹17.5 lakh |

| 30 years | ₹500 | 20 years | ₹4.96 lakh |

| 40 years | ₹500 | 10 years | ₹1.15 lakh |

Notice how the same ₹500 grows drastically depending on when you start.

That’s the power of time in the market, not timing the market.

4. How to Start a SIP with ₹500 — Step-by-Step Guide

Step 1: Define Your Financial Goal

Every SIP must have a purpose.

Are you investing for:

- Higher education?

- A dream vacation?

- Retirement planning?

- Buying a home or car?

Your goal determines the type of mutual fund and time horizon.

Step 2: Choose a Reliable Investment Platform

You can start a SIP online in minutes through platforms like:

- Groww

- Zerodha Coin

- ET Money

- Paytm Money

- Kuvera

- Direct AMC websites (HDFC MF, ICICI MF, Axis MF, etc.)

💡 Tip: Choose Direct Mutual Fund Plans — they have no commission and offer 1%–1.5% higher returns than Regular Plans.

Step 3: Complete KYC Verification

Before investing, you must complete KYC (Know Your Customer) verification.

You’ll need:

- PAN card

- Aadhaar card

- Bank account details

- A clear selfie (for online verification)

Most platforms complete e-KYC within 5–10 minutes.

Step 4: Select the Right Mutual Fund

For a ₹500 SIP, equity mutual funds offer the best long-term potential.

Here’s how to shortlist:

- Investment duration < 3 years: Choose Debt Funds or Liquid Funds.

- 3–5 years: Hybrid or Balanced Advantage Funds.

- 5+ years: Equity or Index Funds.

💡 Pro Tip: Start with a Flexi Cap or Index Fund for stability and growth balance.

Step 5: Set Up Your SIP

Once you’ve selected your fund:

- Enter SIP amount (₹500)

- Choose frequency (monthly)

- Select date (1st, 5th, or 10th is common)

- Enable auto-debit (so it invests automatically each month)

That’s it — you’ve started your SIP journey 🎯

Step 6: Stay Consistent

No matter what the market does — don’t stop your SIP.

Corrections and crashes are your best friend in long-term investing because you buy more units cheaply.

Remember:

“SIPs are built on consistency, not perfection.”

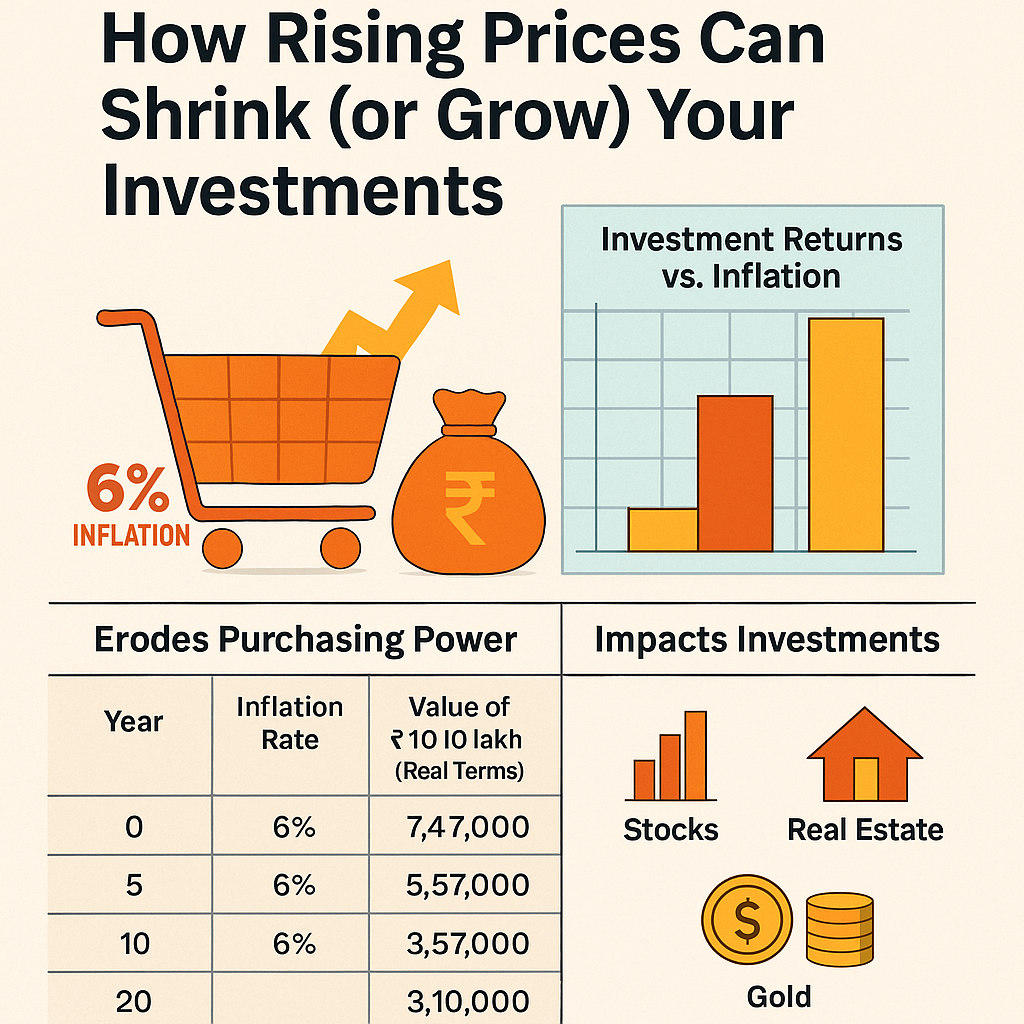

5. How ₹500 Can Turn Into Lakhs (The Magic of Compounding)

Let’s understand visually 👇

| Monthly SIP | Duration | Return (12% CAGR) | Total Investment | Final Value |

|---|---|---|---|---|

| ₹500 | 10 years | 12% | ₹60,000 | ₹1.16 lakh |

| ₹500 | 20 years | 12% | ₹1.2 lakh | ₹4.96 lakh |

| ₹500 | 30 years | 12% | ₹1.8 lakh | ₹17.5 lakh |

Now imagine you increase your SIP by ₹500 every year (Step-Up SIP).

That same 30-year investment can cross ₹35–40 lakh easily.

The earlier and longer you invest, the greater the magic of compounding.

6. Best Mutual Funds to Start a ₹500 SIP (2025 Picks)

| Fund Name | Category | Risk | Ideal Duration |

|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | Moderate | 5+ years |

| Axis Bluechip Fund | Large Cap | Moderate | 5+ years |

| Nippon India Small Cap Fund | Small Cap | High | 7+ years |

| Mirae Asset Large Cap Fund | Large Cap | Moderate | 5+ years |

| UTI Nifty Index Fund | Index Fund | Low | 10+ years |

💡 Tip: Always check fund consistency, expense ratio, and past 5-year performance before investing.

7. SIP vs Lump Sum — Why SIP Wins for Beginners

When markets rise and fall unpredictably, SIPs help you invest without worrying about timing.

| Feature | SIP | Lump Sum |

|---|---|---|

| Market Timing | Not required | Critical |

| Volatility | Balanced | High risk |

| Flexibility | High | Low |

| Ideal For | Beginners | Experienced investors |

With SIPs, you invest in both bullish and bearish markets, and your average cost stays balanced — called Rupee Cost Averaging.

8. Common Mistakes Beginners Should Avoid

❌ Stopping SIPs during market corrections

❌ Expecting quick profits

❌ Investing without a goal

❌ Ignoring fund performance reviews

❌ Mixing too many SIPs at once

👉 Review your SIP every 6–12 months to stay aligned with your goals.

9. Tax Benefits from SIP

If you invest in ELSS (Equity Linked Savings Scheme) funds, your SIPs qualify for tax deductions under Section 80C (up to ₹1.5 lakh per year).

This makes ELSS a smart choice for beginners who also want to save on taxes.

💡 Example:

₹500/month in an ELSS fund = ₹6,000 per year, which qualifies for deduction while earning long-term wealth.

10. How to Increase Your SIP Over Time

Once your income grows, step up your SIP gradually.

- Every 6–12 months, increase SIP by ₹500 or ₹1,000.

- This small increase creates exponential long-term gains.

📊 Example:

₹500 SIP + ₹500 yearly increment → after 25 years, corpus = ₹30+ lakh (at 12% CAGR)

The formula is simple:

Start small, stay regular, grow steadily.

11. Real-Life Example: From ₹500 to Crorepati

Let’s meet Ravi, a 24-year-old who started investing ₹500/month in a Flexi Cap fund.

He increased it by ₹500 every year.

By 50, Ravi’s total investment was ₹7.8 lakh — and his corpus had grown to ₹1.06 crore.

No big risk. No market timing. Just patience.

If he can do it, so can you.

12. Pro Tips for SIP Success

✅ Start now — not “someday.”

✅ Don’t pause during market corrections.

✅ Reinvest dividends for compounding.

✅ Choose Direct Plans, not Regular ones.

✅ Stay invested for at least 5–10 years.

✅ Increase SIPs as your income grows.

Remember:

“Wealth is not built by timing the market, but by spending time in the market.”

Conclusion: Your ₹500 Can Change Your Future

Starting a SIP with ₹500 might feel small, but it’s the first step toward financial independence.

Over time, that small commitment builds discipline, grows through compounding, and gives you the freedom to dream bigger.

So, don’t wait to earn more before you start — start to earn more.

Because wealth is not about how much you invest — it’s about how long you stay invested.

💬 Begin your ₹500 SIP today, and let your money start working harder than you do.

Leave a Reply