Your credit score is more than just a number—it’s a key that unlocks better loan interest rates, higher credit limits, and smoother financial opportunities. In this article, we’ll explore exactly how the credit score system works, why it matters, and most importantly, how you can improve yours—especially relevant if you’re in India (or anywhere) and planning for the future.

What is a Credit Score?

A credit score is a three-digit number (often ranging from about 300 to 850) that reflects how likely you are to repay borrowed money and make payments on time. Consumer Advice+2myFICO+2

Lenders, insurers, landlords and even utility companies may look at it when deciding whether to give you credit, approve you, or set you favourable terms. NerdWallet+1

In short: higher score = less risk for the lender = better opportunities for you. United Way

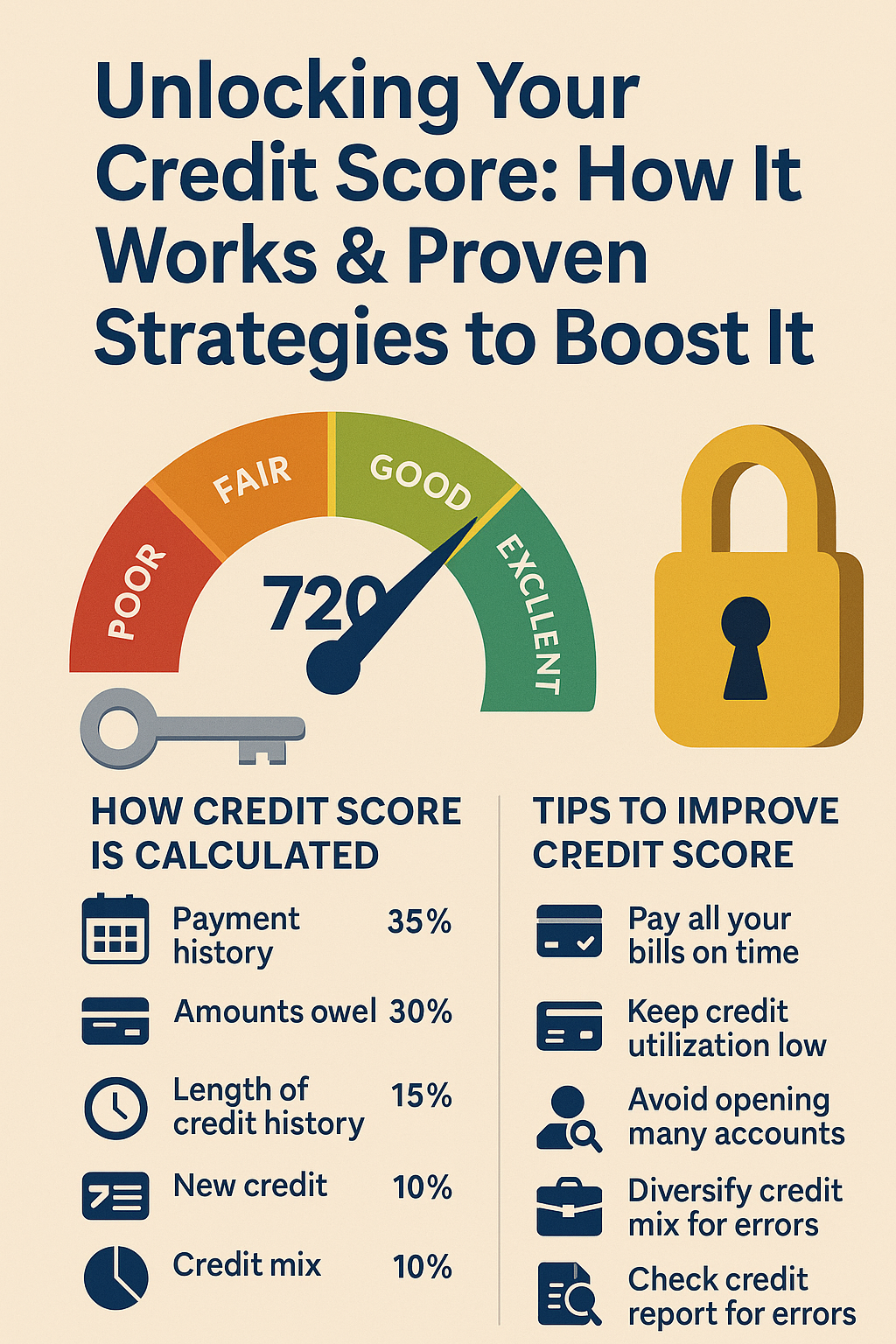

How Credit Scores Are Calculated

While different models exist (like FICO and VantageScore in the US) the core factors are pretty consistent. myFICO+1

Here are the main components:

- Payment History (~35 %)

Whether you’ve paid bills on time (payments missed or late can hurt a lot). Banner Bank+1 - Amounts Owed / Credit Utilisation (~30 %)

How much of your available credit you are using. Lower utilisation is better. Better Money Habits+1 - Length of Credit History (~15 %)

A longer credit history gives more data to assess you. Banner Bank - New Credit / Recent Credit Behaviour (~10 %)

Opening many accounts or loans in a short time can lower your score. Banner Bank - Credit Mix (~10 %)

Having various types of credit (credit cards, instalment loans) can help. NerdWallet

Why Your Credit Score Matters

- It affects the interest rate you’ll be offered on loans: a higher score usually means lower interest. NerdWallet+1

- It influences whether you’ll be approved for loans, credit cards, rental agreements or subscriptions. Consumer Advice

- It can impact non-credit decisions: some insurers, landlords, even utility providers check credit data. NerdWallet

Proven Strategies to Improve Your Credit Score

Here are actionable steps you can take to boost your credit health:

- Pay all your bills on time, every time.

This is the single biggest factor. Late payments hurt. - Keep your credit utilisation low (ideally under 30 %).

If you have a credit card with ₹100,000 limit, try to keep your outstanding balance under ₹30,000. - Don’t close old credit accounts if they have a good payment history.

Keeping older accounts open helps your length of credit history and total available credit. - Avoid opening many new credit lines in a short period.

Each new account can bring a “hard inquiry” which can temporarily lower your score. - Diversify your credit mix if appropriate.

A mix of revolving credit (cards) and instalment loans (car, home, etc) can help—but only if you manage them well. - Check your credit report regularly and dispute errors.

Mistakes can drag your score down. Many countries give you a free annual report. Better Money Habits+1 - Be patient and consistent.

Credit improvement takes time. Positive behaviours build a stronger credit profile over months and years.

Special Considerations for India / Emerging Markets

- In India, many people never check their credit score or credit report, which means they may be unaware of hidden issues. The Economic Times

- The concept of credit scoring is becoming more important with increasing adoption of credit cards, digital lending, and BNPL (“Buy Now, Pay Later”) products. You should monitor how these impact your credit behaviour.

- When applying for loans or cards, ask if the lender reports your repayments to credit bureaus—if not, you don’t build your credit history.

Common Mistakes to Avoid

- Only making minimum payments and carrying high balances.

- Closing a credit card just because you don’t use it—it may reduce your length of history and available credit.

- Applying for too many credit products in quick succession.

- Ignoring your annual credit report or assuming everything is okay.

- Assuming your score won’t affect you until you apply for a big loan — it might already be influencing smaller things (phones, utilities).

Wrap-Up

Understanding your credit score is the first step toward controlling it — rather than letting it control you. The key is consistent, responsible behaviour: pay on time, keep balances low, and give your score time to respond. By doing so, you’ll unlock better credit opportunities, lower borrowing costs, and increased financial flexibility.

Leave a Reply