Intraday trading is one of the fastest and most exciting ways to participate in the stock market. Trades begin and close within the same day, making it a game of sharp decisions, timing, and discipline. While thousands of traders enter intraday trading every day, only those who follow proven strategies are able to trade safely and consistently.

In this detailed guide, we break down the Top 10 Intraday Trading Strategies that actually work—tested, practical, beginner-friendly, and highly effective for Indian markets like NSE & BSE.

Whether you trade Bank Nifty, Nifty 50, stocks, or indices, these strategies will help you trade with confidence and improve your overall accuracy.

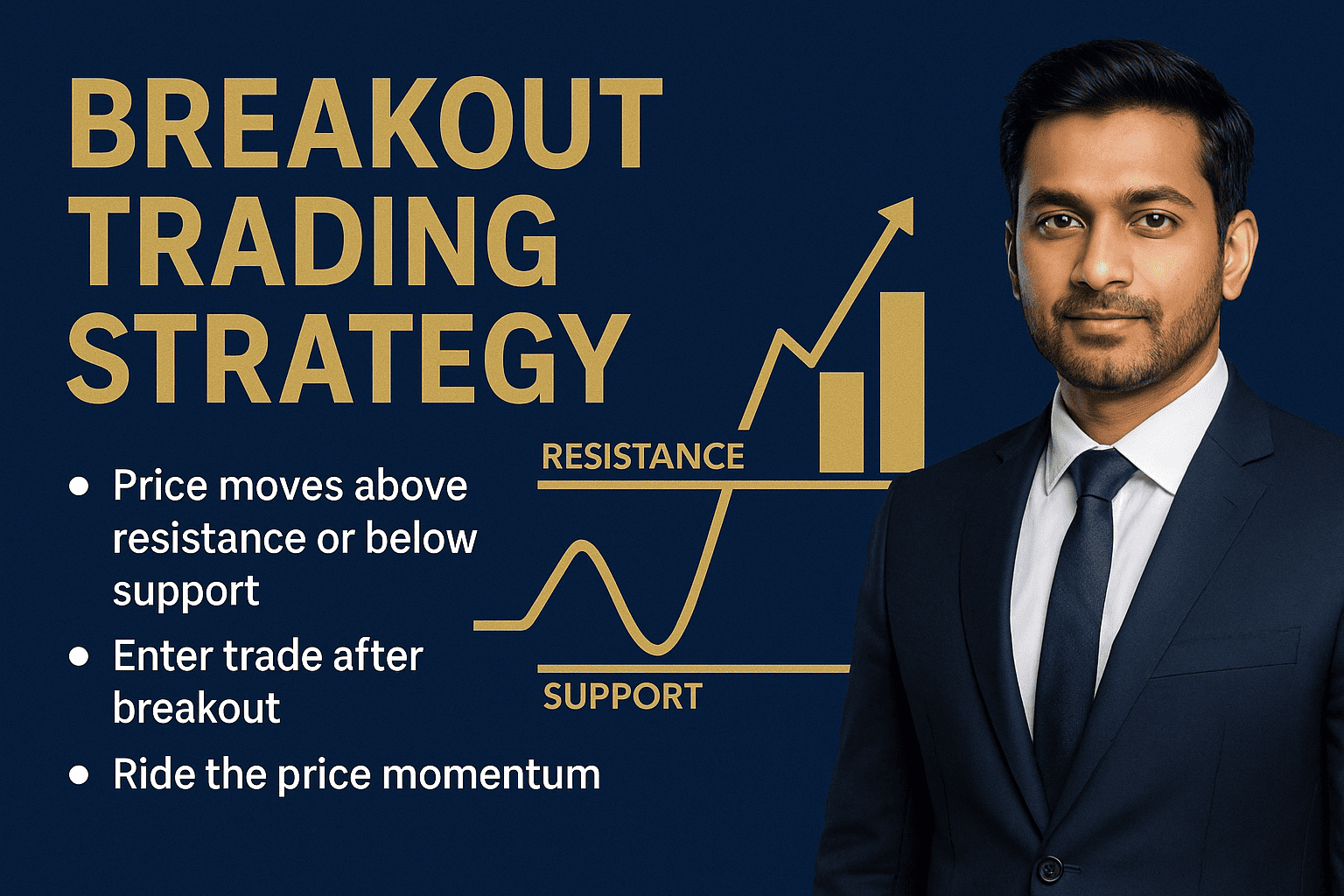

1. Breakout Trading Strategy

Breakout occurs when the price moves above resistance or below support with strong volume. Traders enter the trade right after the breakout and ride the price momentum.

Why It Works

- Captures big intraday moves.

- Breakouts with volume often lead to strong trends.

- Helps avoid confusion during sideways markets.

Tips

- Always check volume before entering a breakout.

- Use smaller timeframes like 5-minute or 15-minute charts.

- Avoid weak, false breakouts during low-volume periods.

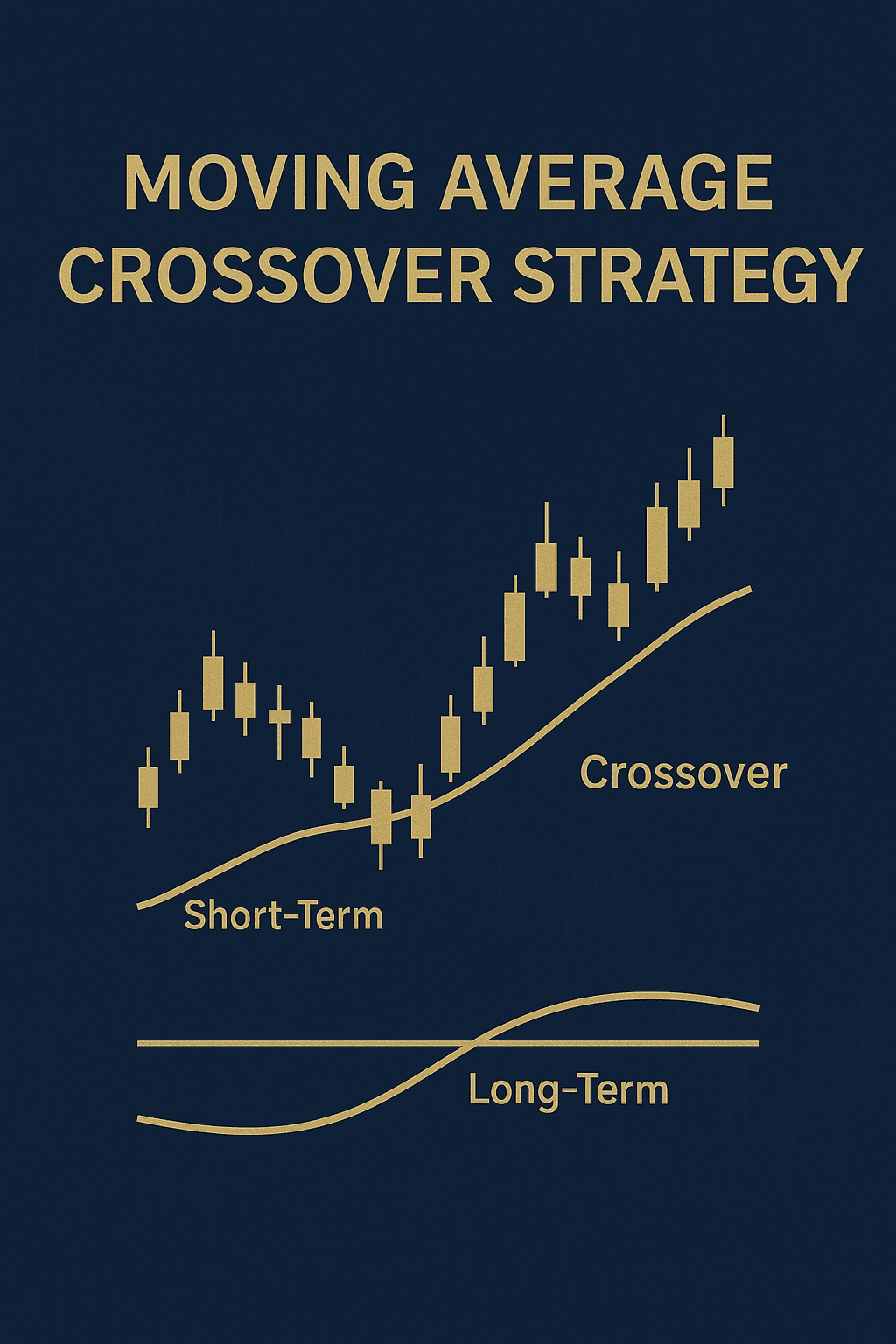

2. Moving Average Crossover Strategy

Moving averages help identify trend direction. A crossover occurs when a short-term moving average crosses above or below a long-term moving average.

Popular Combinations

- 9 EMA + 21 EMA

- 20 SMA + 50 SMA

- 50 EMA + 200 EMA (Golden/Death crossover)

Why It Works

- Gives clear buy/sell signals.

- Works best in trending markets.

- Reduces emotional decision-making.

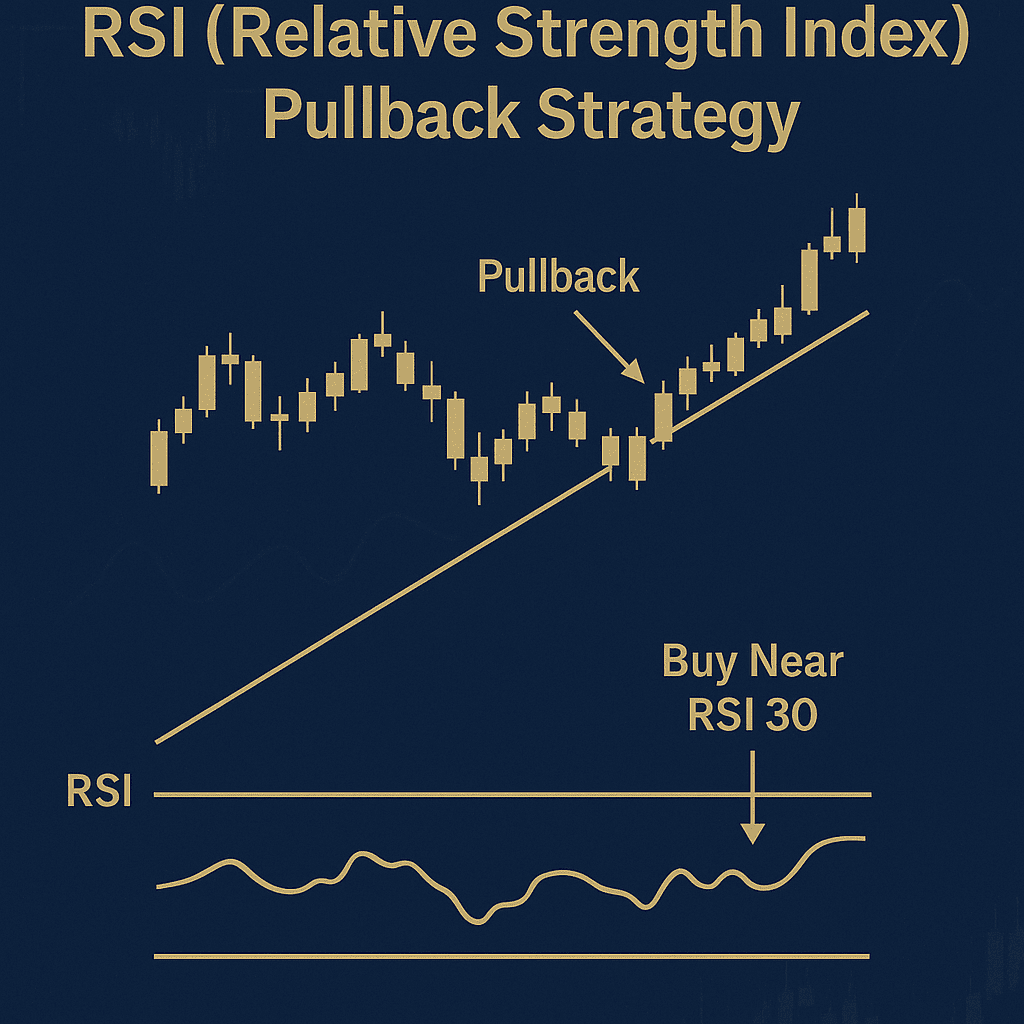

3. RSI (Relative Strength Index) Pullback Strategy

RSI helps identify overbought and oversold zones. In intraday trading, RSI pullback entries are highly accurate.

Rules

- Buy near RSI 30 levels in an uptrend.

- Sell near RSI 70 levels in a downtrend.

- Use 14-period RSI on 5m or 15m charts.

Why It Works

- Pullbacks offer low-risk entry points.

- Reduces chances of entering at the top or bottom.

- Effective for volatile stocks and indices.

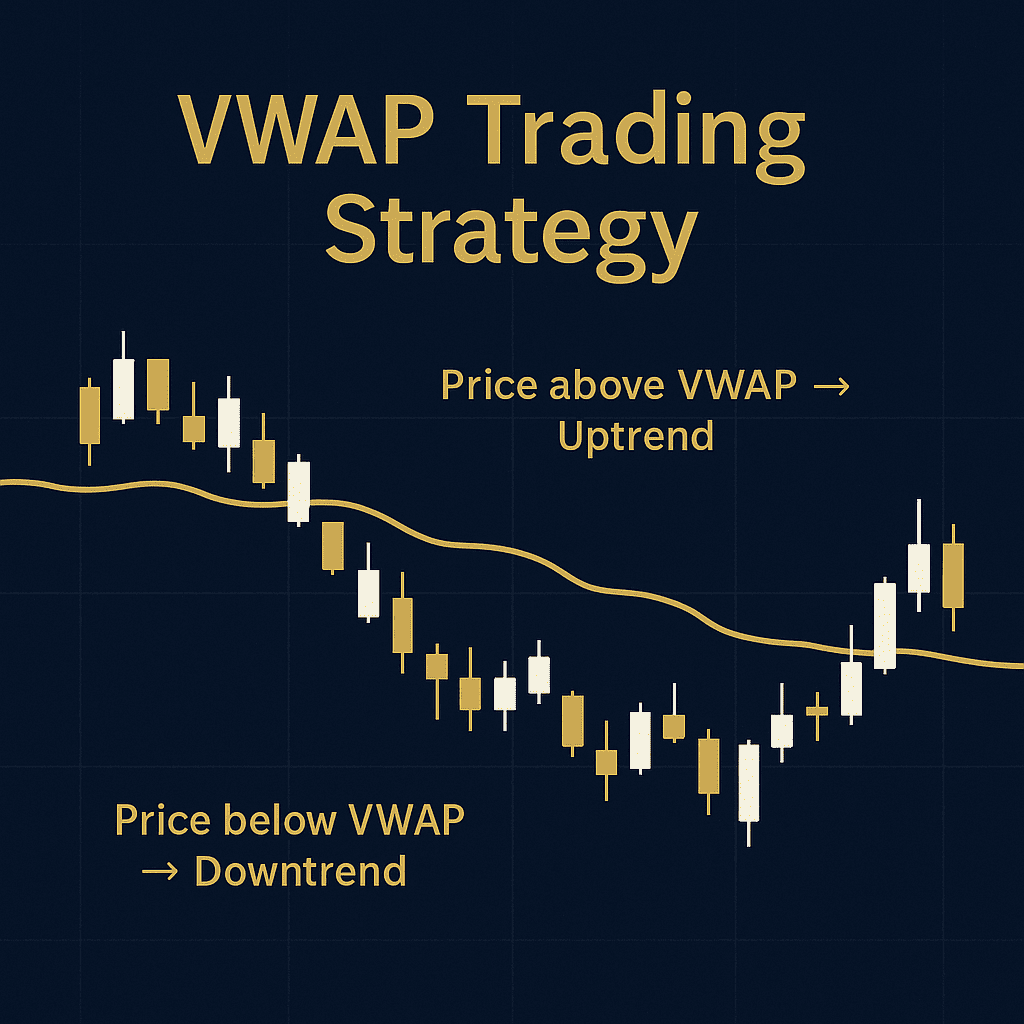

4. VWAP Trading Strategy

VWAP (Volume Weighted Average Price) is one of the most trusted indicators for intraday traders.

How to Use It

- Price above VWAP → Uptrend → Look for buys.

- Price below VWAP → Downtrend → Look for sells.

- Re-tests and bounces from VWAP give high-probability entries.

Why It Works

- Smart money traders — FIIs, DIIs — watch VWAP closely.

- Helps avoid trades against the trend.

- Clear and visually simple strategy.

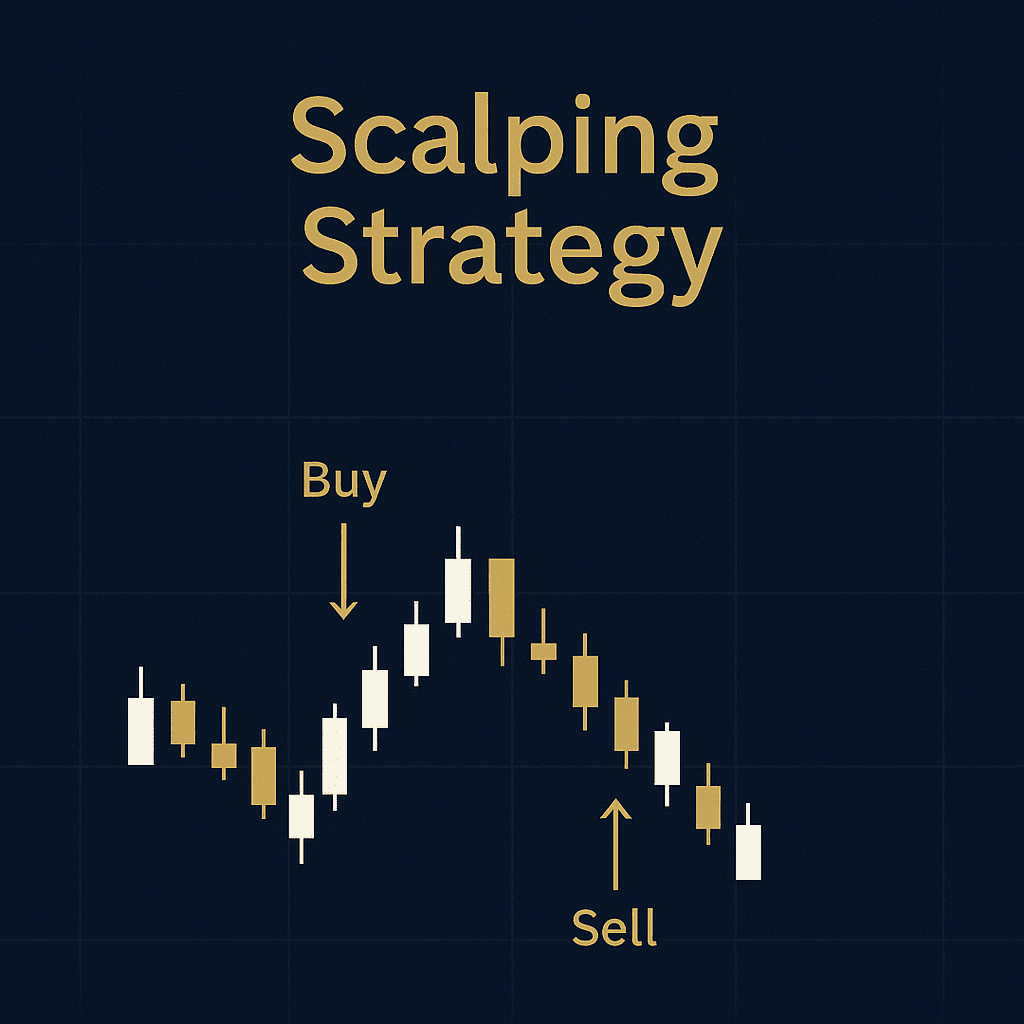

5. Scalping Strategy

Scalping involves taking multiple small trades to capture tiny price movements. This is ideal for highly liquid stocks or indices like Bank Nifty.

Requirements

- Fast execution.

- Tight stop-loss.

- Instant decision-making.

Why It Works

- Small profits add up quickly.

- Low market exposure reduces risk.

- Perfect during high volatility.

6. Gap-Up & Gap-Down Strategy

Stocks that open with a gap often continue in the same direction, especially if backed by news or strong momentum.

Rules

- Gap-up with volume → Look for buying opportunities.

- Gap-down with volume → Look for selling opportunities.

- Use the first 15-minute candle to confirm direction.

Why It Works

- Gaps are driven by strong overnight sentiment.

- Traders can ride big intraday trends from the start.

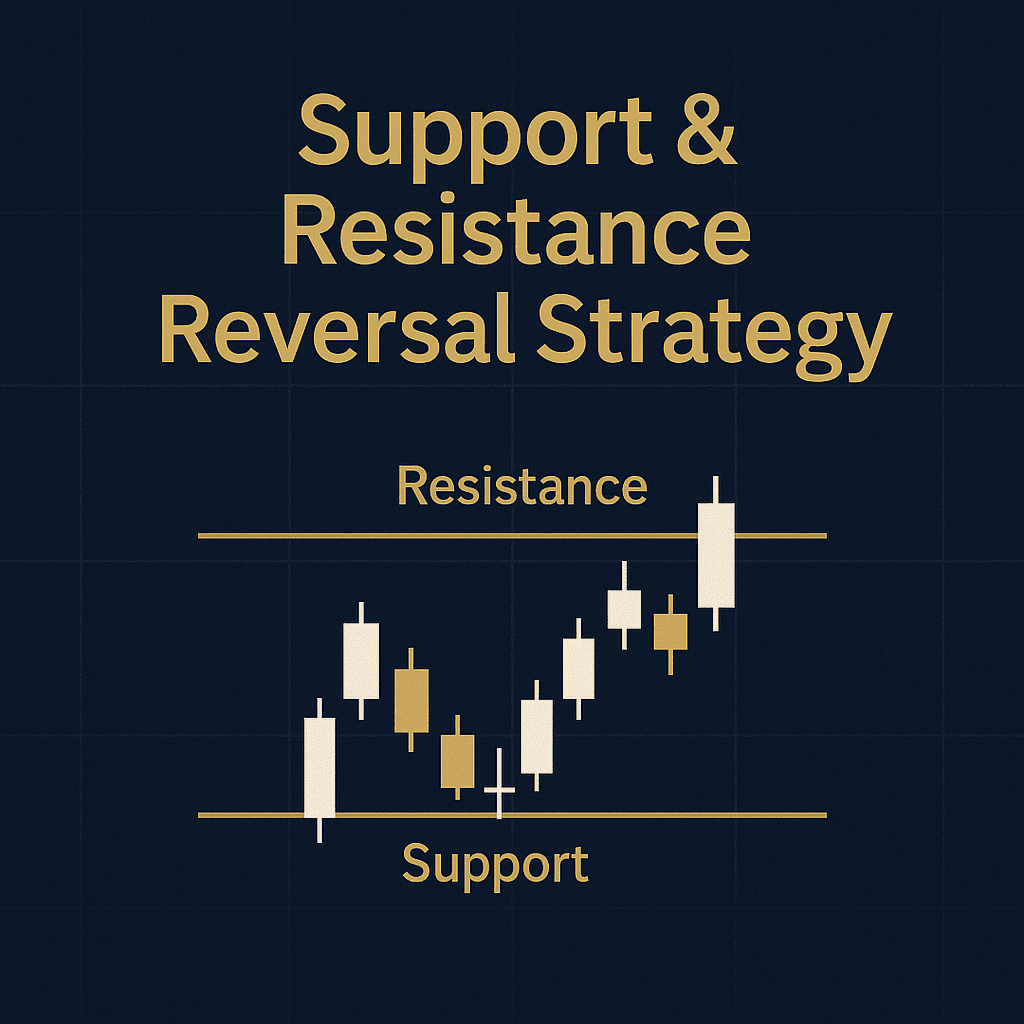

7. Support & Resistance Reversal Strategy

Price often reverses after hitting major support or resistance zones. Identifying these levels gives powerful intraday entries.

How to Use

- Draw levels on 15m, 1H, and daily timeframes.

- Buy near major support.

- Sell near major resistance.

- Add confirmation using volumes or RSI.

Why It Works

- Market respects major levels.

- Offers low-risk entries with clear stop-losses.

- Works in both trending and sideways markets.

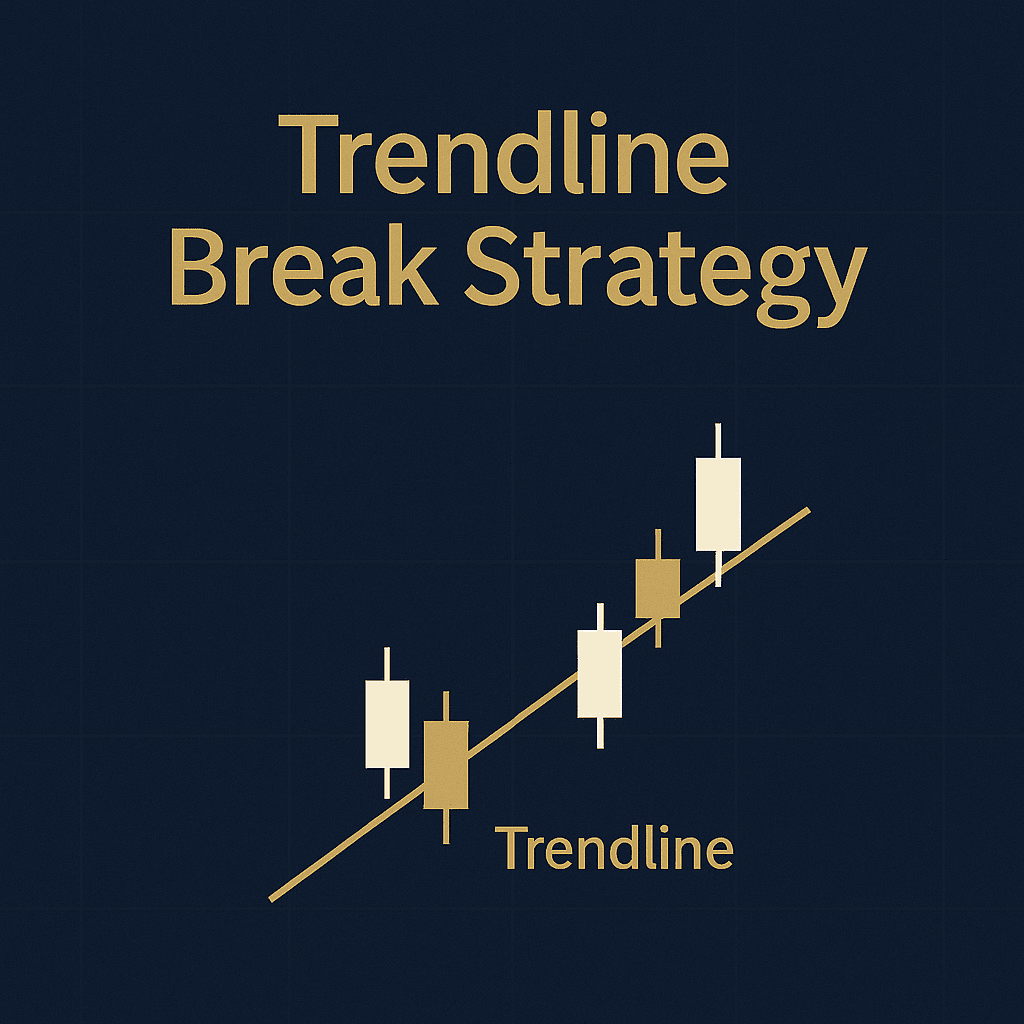

8. Trendline Break Strategy

Trendlines show the direction of the market. When a trendline breaks, a new trend often begins.

Rules

- Draw trendlines connecting multiple swing points.

- Enter after a clear breakout with volume.

- Avoid weak breakouts without confirmation.

Why It Works

- Captures early trend changes.

- Helps avoid late entries.

- Reliable across all stocks and timeframes.

9. CPR (Central Pivot Range) Strategy

CPR is highly popular among professional intraday traders. It gives targets, trend direction, and high-probability zones.

How to Use CPR

- Narrow CPR → Trend day.

- Wide CPR → Sideways day.

- Trade breakouts above/below CPR levels.

Why It Works

- CPR gives structured trading levels.

- Excellent for Bank Nifty and Nifty traders.

- Works effectively with strong market momentum.

10. News-Based Intraday Strategy

Trading during results, announcements, policy changes, or market-moving news can give quick profits.

Examples

- RBI policy

- Budget session

- Company results

- Mergers & acquisitions

- Global market updates

Why It Works

- High volatility = high opportunity.

- Rapid movement gives quick trades.

Caution

- Use strict stop-loss.

- Avoid trading without confirmation.

Bonus Tips for Safe Intraday Trading

✔ Always Use Stop-Loss

✔ Avoid Overtrading

✔ Trade Only 2–3 High-Quality Setups

✔ Don’t Chase the Market

✔ Keep Position Size Controlled

✔ Follow Market Trend, Not Emotions

✔ Review Trades at the End of the Day

Conclusion

Intraday trading requires discipline, strategy, and consistency. These Top 10 Intraday Trading Strategies are proven to work across different market conditions. Whether you’re a beginner or a skilled trader, these methods will help you make better decisions, reduce losses, and improve your overall accuracy.

Use them with proper risk management, avoid emotional trading, and always trade with a plan.

If you want, I can also create:

- Featured Image (navy blue & gold theme)

- Section-wise images for your blog

- Infographics for social media

- Pinterest-style vertical images

Just tell me: “Gabar, create images” and I’ll generate instantly.

Leave a Reply