Moving averages (MA) are among the most trusted technical indicators in the stock market. Whether you’re an intraday trader, swing trader, or long-term investor, understanding moving averages helps you identify trend direction, entry opportunities, exit points, support-resistance zones, and market momentum.

This guide explains moving averages in a simple, practical, human-friendly way — using real examples, charts, and everyday scenarios to make everything easy and actionable.

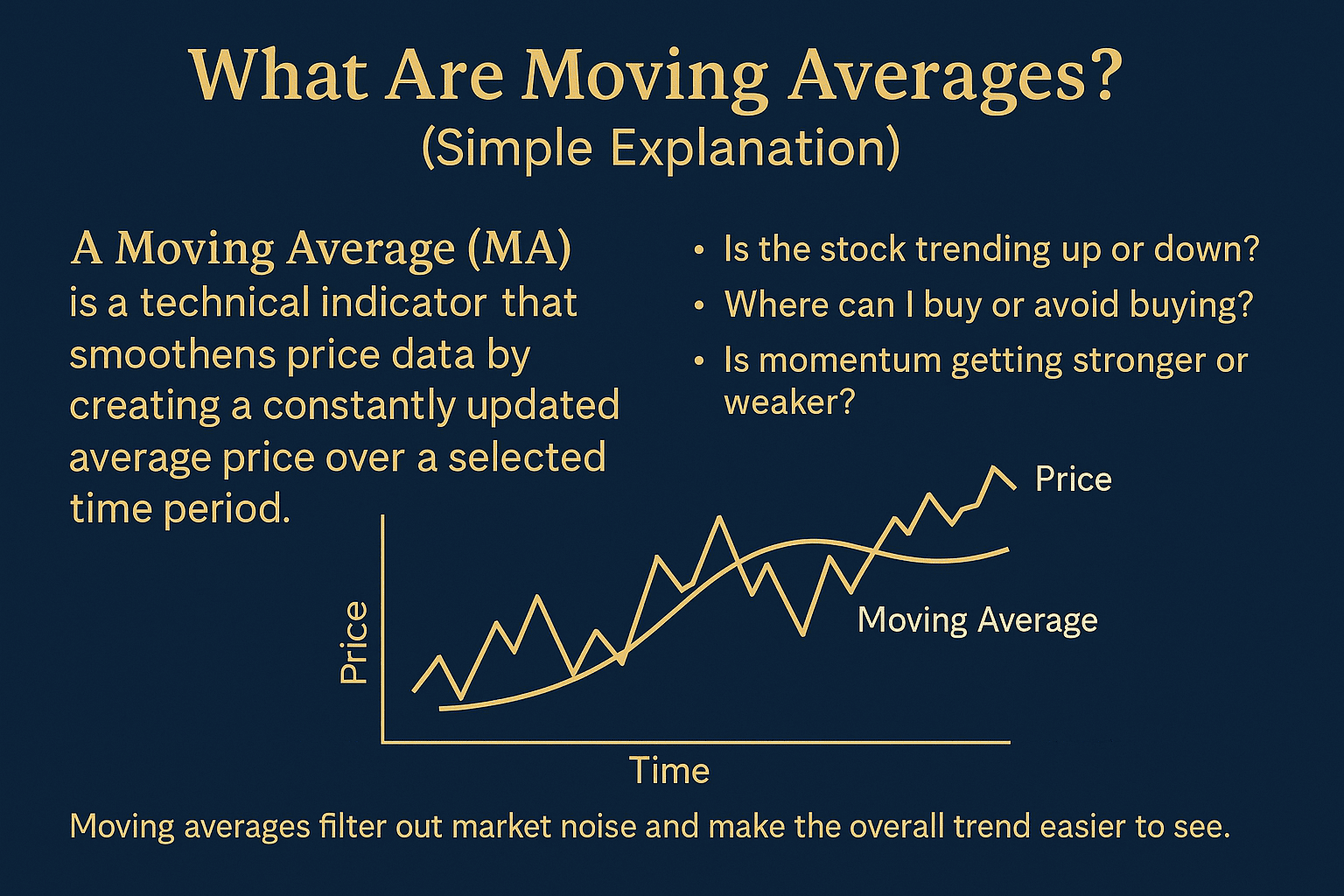

📌 What Are Moving Averages? (Simple Explanation)

A Moving Average (MA) is a technical indicator that smoothens price data by creating a constantly updated average price over a selected time period.

It helps traders answer questions like:

- Is the stock trending up or down?

- Is momentum getting stronger or weaker?

- Where can I buy with low risk?

- Where should I avoid buying?

Moving averages filter out market noise and make the overall trend easier to see.

✅ Types of Moving Averages

There are many types, but the market mostly uses these three:

1️⃣ Simple Moving Average (SMA)

The Simple Moving Average calculates the average closing price over a defined time period.

✨ Example:

A 20-Day SMA adds the closing prices of the last 20 days and divides by 20.

✔ What SMA Shows:

- Trend direction

- Support & resistance levels

- Long-term stability

📉 Real-Market Example:

If Reliance (RELIANCE.NS) is trading above the 50-SMA, it usually indicates a strong uptrend. If it breaks below the 50-SMA, the trend may turn weak.

2️⃣ Exponential Moving Average (EMA)

EMA gives more weight to recent prices, making it faster and more responsive than SMA.

✨ Example:

In intraday trading, the 9-EMA and 21-EMA are widely used for spotting trend shifts.

✔ What EMA Shows:

- Quick momentum change

- Fast signals for entries/exits

- Ideal for intraday & swing trading

📉 Real-Market Example:

Bank Nifty often uses 9-EMA as a support during bullish rallies. When it closes below the 9-EMA, a correction usually follows.

3️⃣ Weighted Moving Average (WMA)

WMA assigns weight to each price point — the most recent price gets the highest weight.

✔ When to Use:

- When price changes fast

- When you want sensitivity + accuracy

🚀 Why Moving Averages Are Important

Moving averages help you:

✔ Identify the Trend

“Trend is your friend.”

MAs clearly show whether the trend is UP, DOWN, or SIDEWAYS.

✔ Spot Support & Resistance

Moving averages often act as dynamic support and resistance.

Example:

- 50-SMA → Medium-term support

- 200-SMA → Long-term institutional support

✔ Generate Buy & Sell Signals

Moving averages give clean trading signals:

- Price crossing above MA → Buy

- Price crossing below MA → Sell

✔ Avoid Fake Breakouts

Traders use EMA/SMA to confirm whether a breakout is real or trap.

🔥 Popular Moving Average Strategies (With Examples)

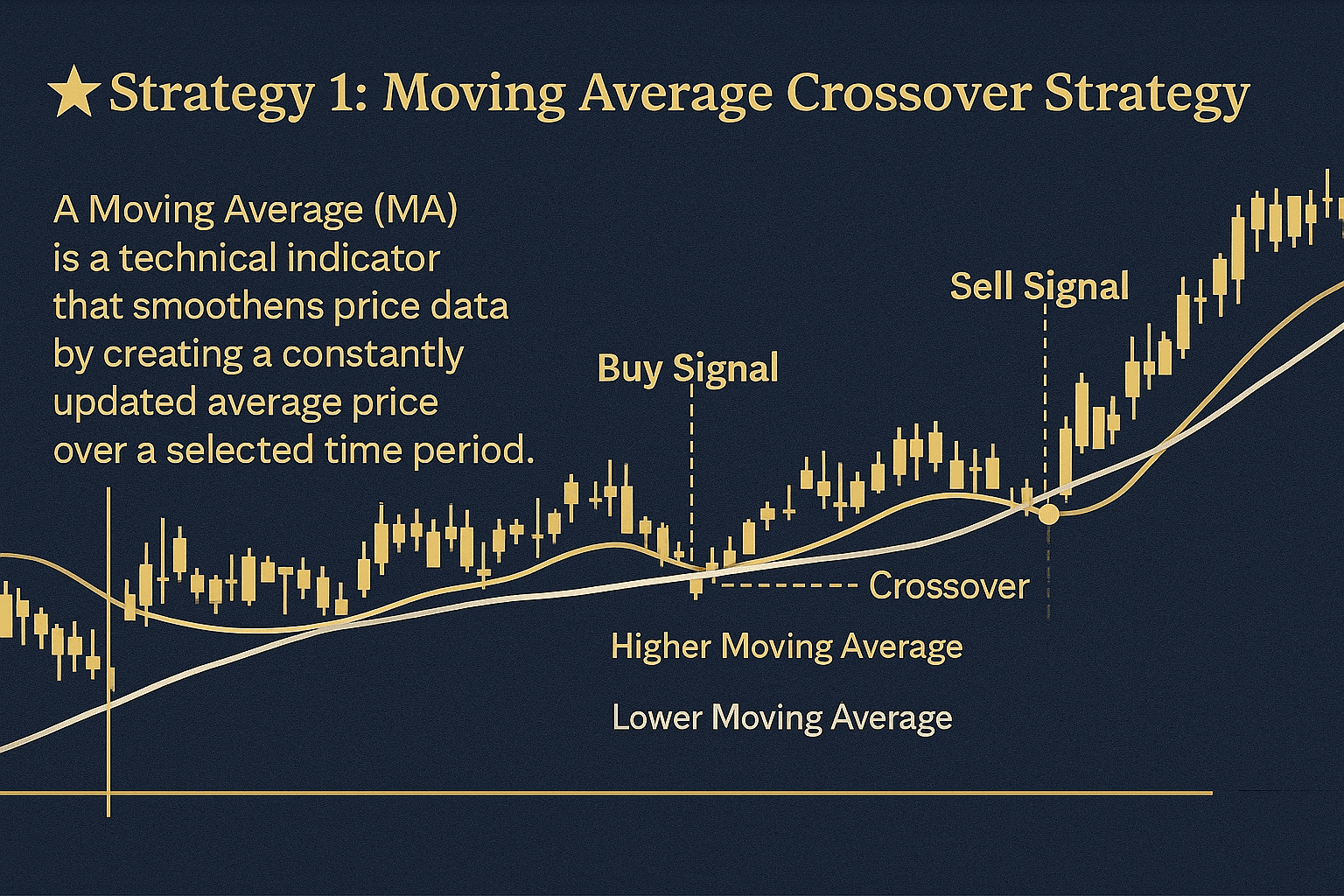

⭐ Strategy 1: Moving Average Crossover Strategy

This occurs when a fast MA crosses a slow MA.

✔ Best Timeframes:

- Intraday: 9-EMA & 21-EMA

- Swing Trading: 20-SMA & 50-SMA

- Long-Term: 50-SMA & 200-SMA

📉 Example:

Golden Cross

50-SMA crosses above 200-SMA → Strong long-term buy signal.

Death Cross

50-SMA crosses below 200-SMA → Strong bearish signal.

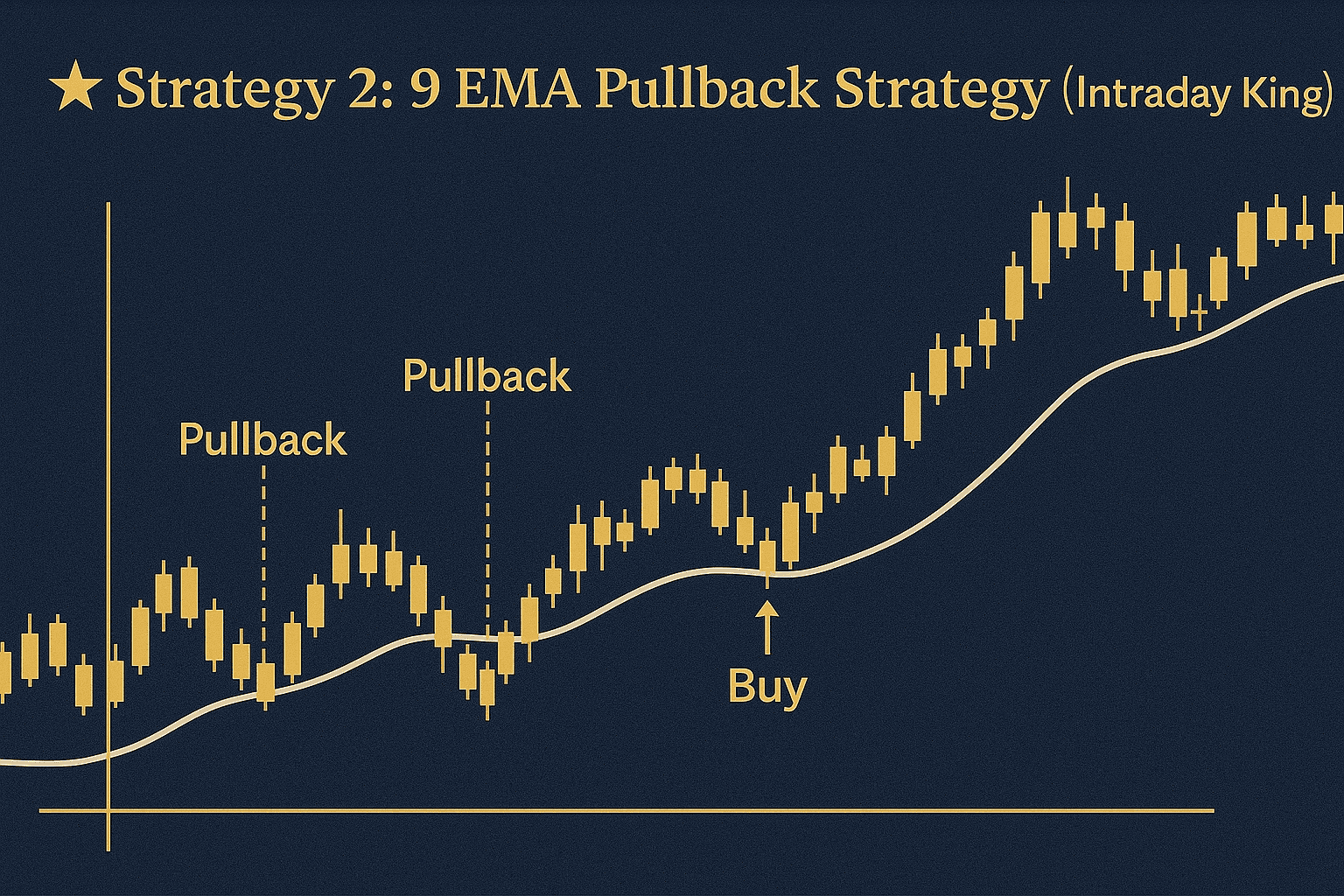

⭐ Strategy 2: 9 EMA Pullback Strategy (Intraday King)

This is the most powerful intraday strategy used by pros.

How it works:

- Identify uptrend using 21-EMA.

- Wait for price to pull back to 9-EMA.

- Enter on bullish candle formation.

Example:

Bank Nifty rallies strongly when respecting 9-EMA on 5-min chart.

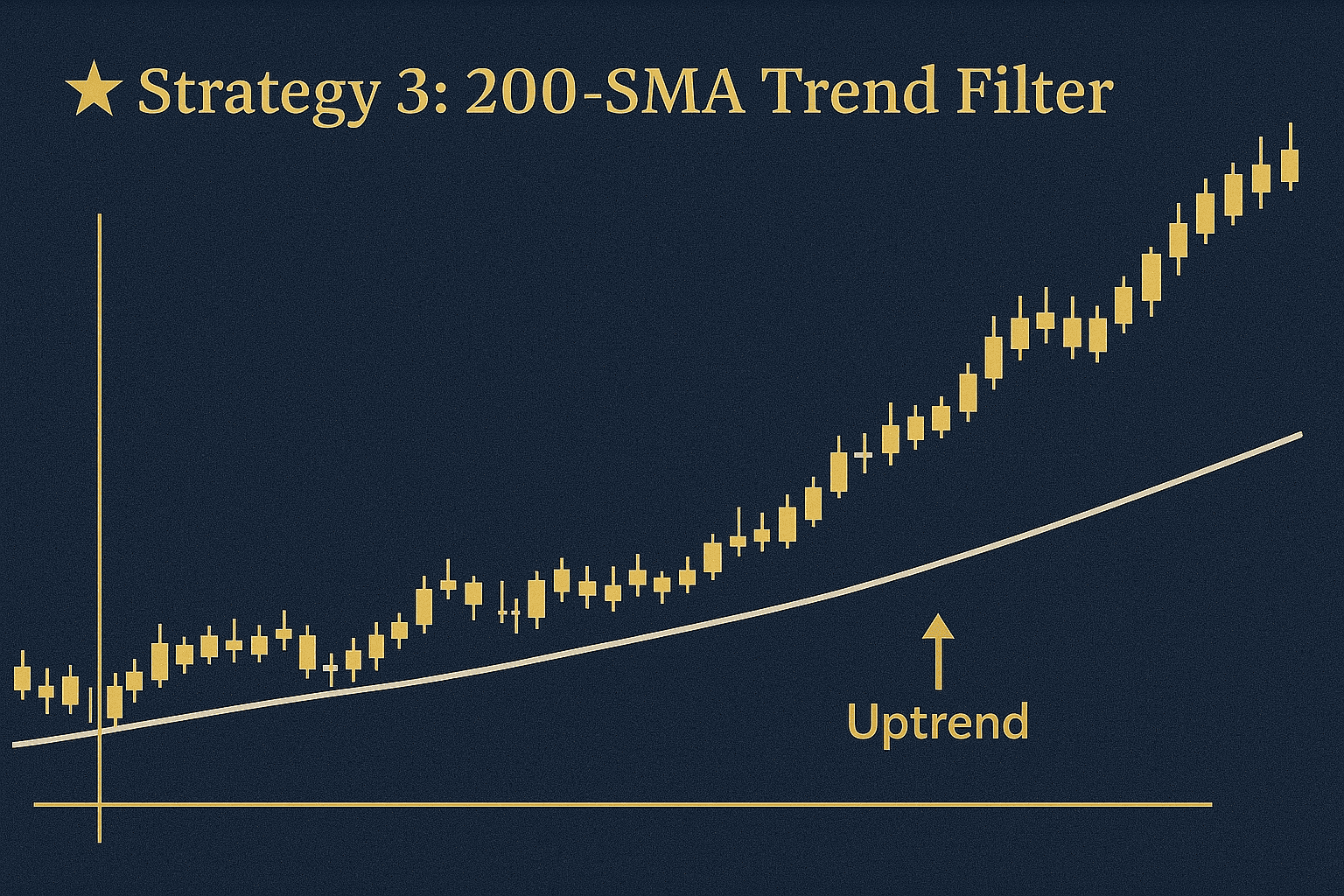

⭐ Strategy 3: 200-SMA Trend Filter

Institutions and mutual funds track the 200-SMA.

✔ Rules:

- Price above 200-SMA → Only long trades

- Price below 200-SMA → Only short trades

Example:

NIFTY 50 usually stays above 200-SMA during bull markets.

⭐ Strategy 4: Dynamic Support & Resistance Strategy

Price respects EMAs as support or resistance.

Example:

- Tata Motors taking support at 20-EMA, bouncing higher multiple times.

- HDFC Bank rejecting resistance at 50-EMA.

📊 Real-Life Market Examples

📍 Example 1: NIFTY 50 Trend Reversal Using 50-SMA

When NIFTY closes above 50-SMA after a correction, a strong reversal often begins.

📍 Example 2: Reliance Using 200-SMA

Reliance tends to bounce near its 200-Day SMA, indicating institutions are accumulating.

📍 Example 3: Intraday Example with EMA

BankNifty respecting 9-EMA during high-momentum trends on the 5-min chart.

🧠 How to Choose the Right Moving Average

| Trader Type | Best MA | Best Use |

|---|---|---|

| Intraday | 9-EMA, 21-EMA | Quick trend, pullbacks |

| Swing Trader | 20-SMA, 50-SMA | Trend direction |

| Long Term | 100-SMA, 200-SMA | Major trend filter |

| Option Trader | 9-EMA, 21-EMA | Momentum shifts |

❗ Common Mistakes Traders Make with Moving Averages

❌ Using too many MAs

Leads to confusion — keep it simple.

❌ Not combining with price action

MA alone isn’t enough — use candlesticks too.

❌ Blindly entering on every crossover

Look for trend confirmation.

❌ Ignoring higher timeframes

Always check the trend on bigger charts.

🌟 Best Settings for Moving Averages

✔ For Intraday:

- 9-EMA

- 21-EMA

- 50-EMA

✔ For Swing:

- 20-SMA

- 50-SMA

- 100-SMA

✔ For Positional & Long-Term:

- 100-SMA

- 200-SMA

✔ For Confirmation:

Use 200-SMA as the backbone of trend direction.

🧠 Do Moving Averages Work in All Markets?

Yes, but better in:

- Trending markets

- Volatile phases

- Stocks with high liquidity

Not effective in:

- Sideways markets

- Low-volume stocks

- Choppy phases

🏁 Conclusion: Why Moving Averages Are Essential for Traders

Moving averages help you:

- Understand market trend clearly

- Avoid bad trades

- Identify low-risk entries

- Catch big moves early

- Stay aligned with smart money

Whether you trade stocks, indices, forex, or crypto — moving averages are simple but extremely powerful tools.

If you combine EMAs/SMAs with proper price action (candlesticks, support/resistance), your trading accuracy increases drastically.

Leave a Reply