Introduction

Bull vs Bear Market: If you have invested in the stock market, you may have seen that the market never moves in one straight line. Some days, most stocks go up, and everything looks good. On other days, prices fal,l and people start worrying. This up and down movement is normal, but many investors feel confused because they do not know which market phase is going on.

When you understand whether the market is going up or going down, it becomes very helpful. You cannot know the future for sure, but this knowledge helps you avoid common mistakes. For example, it can stop you from buying when prices are too high or selling in fear when prices fall. Slowly, this makes you a calmer and smarter investor.

In this article, I will explain bull and bear market phases in very easy words. I will not use hard or confusing terms. Even if you are new to the stock market, you will be able to understand everything clearly.

Follow Admin on LinkedIn / Follow our LinkedIn Page for More Updates / Learn Trading through Paper Trade

What is a Bull Market?

A bull market is a time when stock prices keep going up for a long period. Usually, when prices rise about 20% or more from their recent low, it is called a bull market. This phase does not end fast. It can continue for many months or even years.

During a bull market, the mood of the market feels good. Most news is positive, companies show better results, and people feel more confident about putting their money into stocks.

Common Signs of a Bull Market

- Stock prices keep going up slowly and steadily

- The economy starts growing

- More people get jobs

- Companies earn more profit

- Investors feel hopeful about the future

In a bull market, people are more ready to take risks. Long-term investments usually do well because the market is moving upward overall.

What Is a Bear Market?

A bear market is the opposite of a bull market. It happens when stock prices fall 20% or more from their recent high level. During this time, fear and negative news are seen more often. People start feeling unsure about the market.

Many investors, especially beginners, feel scared and uncomfortable in a bear market.

Common Signs of a Bear Market

- Stock prices have been falling for many weeks or months

- The economy slows down

- More people lose jobs

- People spend less money

- Many investors sell shares in panic

A bear market may look scary, but it is a normal part of the market. Many experienced investors actually wait for this time because good stocks can be bought at lower prices for long-term investment.

Market Cycles: Why Bull and Bear Markets Keep Repeating

The stock market moves in cycles. It does not stay in a bull market or a bear market forever. Over time, it keeps changing. Most of the time, the market goes through four main stages.

Accumulation is the first stage. In this stage, big investors slowly start buying shares without making much noise.

Markup is the next stage. Prices begin to rise, and people start feeling positive. This stage is called a bull market.

Distribution comes after that. Prices are high, and some investors start selling their shares to take profit.

Markdown is the last stage. Prices start falling, fear spreads in the market, and this stage is known as a bear market.

When you understand this cycle, the market’s ups and downs become easier to understand and less confusing.

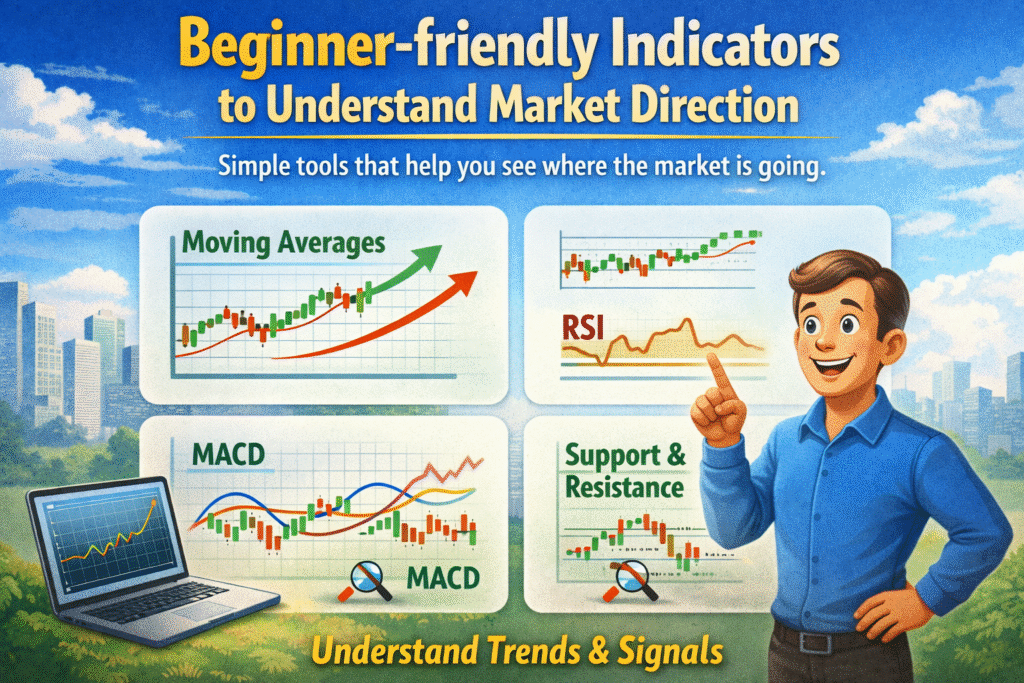

Beginner-friendly indicators to understand market direction

You do not need hard or advanced tools to understand which way the market is going. Some simple signs are enough to get a basic idea.

Moving Averages

The 200-day moving average is a very common tool.

- When prices stay above this line, the market is usually strong and positive

- When prices stay below this line, the market often becomes weak

Market Trend

- When prices keep making higher highs and higher lows, it usually means a bull market

- When prices make lower highs and lower lows, it usually means a bear market

Trading Volume

- When prices rise with high trading volume, it shows that many people are buying

- When prices fall with heavy volume, it shows strong selling pressure

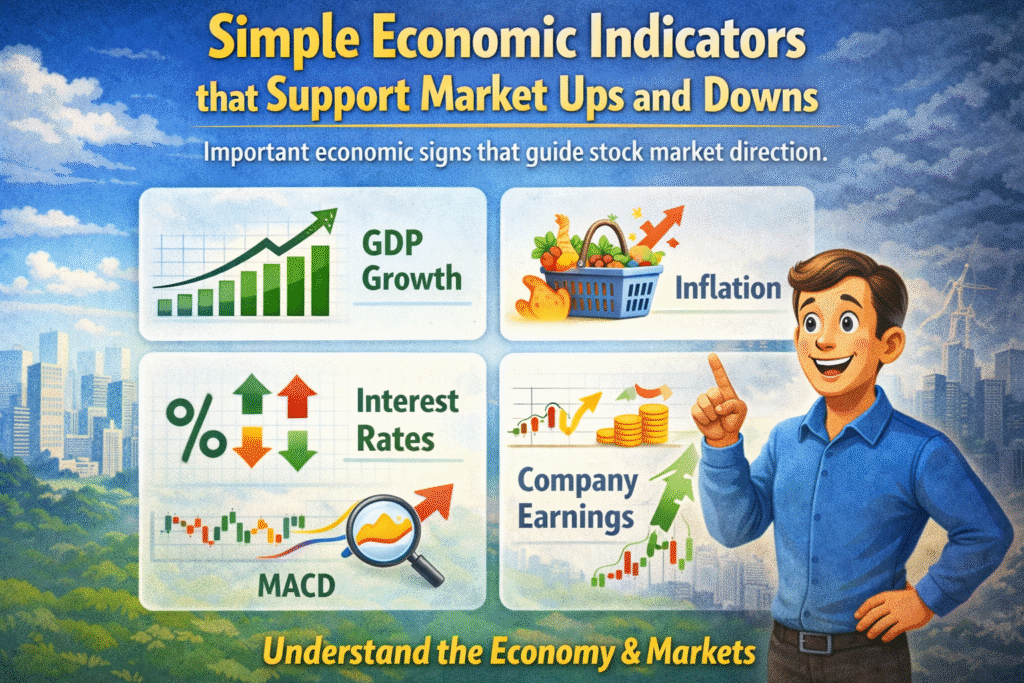

Simple economic indicators that support market ups and downs

Market movement is closely linked to the economy.

- GDP

When the economy grows well, markets usually perform better. - Inflation

Controlled inflation is healthy. Fast-rising inflation creates pressure. - Interest Rates

Stable or falling rates support growth. Rising rates slow markets down. - Company Earnings

Growing profits support bull markets. Falling profits weaken confidence.

Many investors learn these basics from educational platforms like Investopedia.

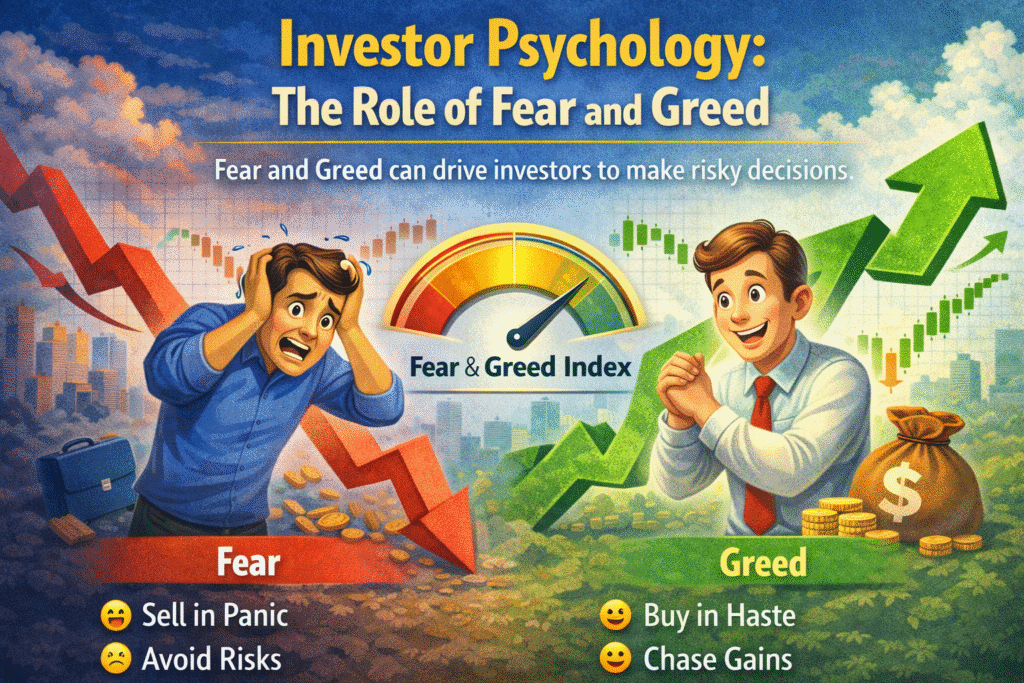

Investor Psychology: The Role of Fear and Greed

The stock market is not moved only by numbers. Human feelings also play a big role.

When the market goes up, people feel confident and sometimes become greedy. When the market goes down, fear and panic start taking over. Some tools, like the Fear and Greed Index, are used to understand these emotions in the market.

If you understand how investors think and feel, it becomes easier to avoid emotional and hurried decisions.

Common Mistakes Most Investors Make

A lot of investors lose money not because the market is bad, but because of emotional mistakes.

- Buying stocks after prices have already risen too much

- Selling in panic during market crashes

- Ignoring long-term trends

- Reacting too quickly to daily news

Successful investors learn to stay calm and patient.

Simple investing tips for bull and bear markets

During a Bull Market

- Focus on good quality, growing companies

- Stay invested for the long term

- Use stop-loss to protect profits

During a Bear Market

- Protect your capital

- Diversify your investments

- Focus on safer or defensive sectors

- Look for strong stocks at discounted prices

Also Read – FIIs and DIIs Explained: Why They Are Important for Market

Bull vs Bear Market: FAQs

How much time do bull markets usually last?

Ans – Bull markets can last for many years, depending on economic conditions.

Can a bear market turn bullish suddenly?

Ans – Yes. When conditions improve, markets can recover faster than expected.

Is a correction the same as a bear market?

Ans – No. Corrections fall 10–19%, while bear markets fall 20% or more.

Are bear markets bad for everyone?

Ans – Not really. Long-term investors often find the best opportunities during bear markets.

Can beginners understand market phases?

Ans – Yes. With time and observation, beginners can learn market behavior.

Final Thoughts

Markets will always rise and fall — that’s the nature of investing. But when you understand bull and bear market phases, you stop reacting emotionally and start thinking clearly.

By watching trends, basic indicators, economic data, and investor behavior, you can become a more confident and disciplined investor over time.

Leave a Reply