📘 Introduction: Why Stop Loss & Take Profit Matter More Than Your Trade Setup

Most beginners focus only on entries — “Kab buy karein?” — but the truth is:

👉 Your exit decides your profit or loss, not your entry.

Stop Loss (SL) and Take Profit (TP) are the two most important pillars of safe trading.

Without them, even a good trader eventually wipes out their account.

This guide explains:

- What SL & TP are

- Why they protect you

- Best strategies to calculate both

- Real trading examples

- Mistakes traders make

- Pro-level tips to grow consistently

Let’s begin your journey towards safe, profitable trading.

📍 What is Stop Loss? (SL)

Stop Loss is a pre-decided price level where you automatically exit a losing trade.

It protects your capital when the market moves against you.

Why Stop Loss Is Important

- Prevents big losses

- Controls emotions

- Helps you trade with discipline

- Saves your account during volatile moves

- Makes trading stress-free

Think of SL like a seatbelt — you hope you don’t need it, but it saves you when something goes wrong.

📍 What is Take Profit? (TP)

Take Profit is a pre-decided price where you exit in profit automatically.

Why Take Profit Helps You Win

- Locks in profits before market reverses

- Removes greed

- Ensures systematic profit booking

- Helps maintain risk–reward ratio

- Makes earnings consistent

TP protects traders from “Thoda aur wait kar leta hoon…” type mistakes.

🎯 How to Set Stop Loss Correctly

Setting Stop Loss is an art + science. Here are the most effective methods:

1️⃣ Percentage-Based Stop Loss

Very beginner-friendly.

Example:

- Risk only 1% of your capital per trade.

- If capital = ₹50,000 → max loss allowed = ₹500.

Simple and safe.

2️⃣ Technical Levels Stop Loss

SL placed below/above key technical zones:

- Support

- Resistance

- Swing highs & lows

- Breakout/breakdown levels

- Moving averages

- Trendlines

Example:

If Bank Nifty breaks support at 48500, your SL should be just below it — like 48460.

3️⃣ ATR-Based Stop Loss

ATR (Average True Range) shows market volatility.

Formula:

SL = Entry Price – (ATR × Multiplier)

Perfect for intraday and swing trades.

4️⃣ Candle-Based Stop Loss

SL placed below/above:

- Previous candle low

- Doji low/high

- Hammer low

- Engulfing lower wick

This works great for price action traders.

5️⃣ Time-Based Stop Loss

If your trade doesn’t move in expected direction within a certain time, EXIT.

Best for intraday.

🎯 How to Set Take Profit Levels

Here are top methods to set TP accurately:

1️⃣ Risk–Reward Ratio (RRR) Method

Most reliable.

If your SL = ₹10

Take Profit should be = ₹20 (RRR = 1:2)

Professional traders use RRR between 1:2 to 1:3.

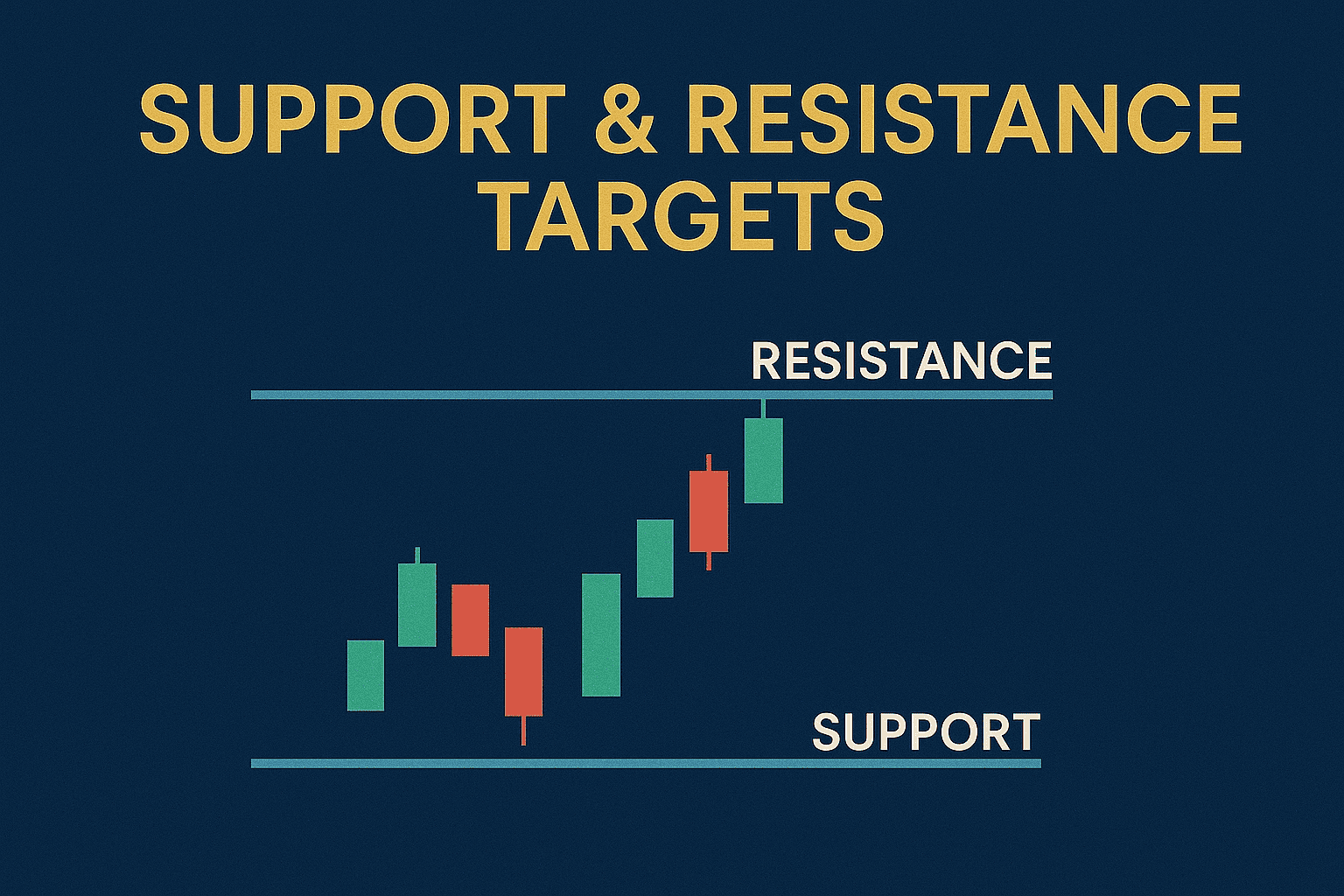

2️⃣ Support & Resistance Targets

Book profit at:

- Next resistance (in uptrend)

- Next support (in downtrend)

Simple & powerful.

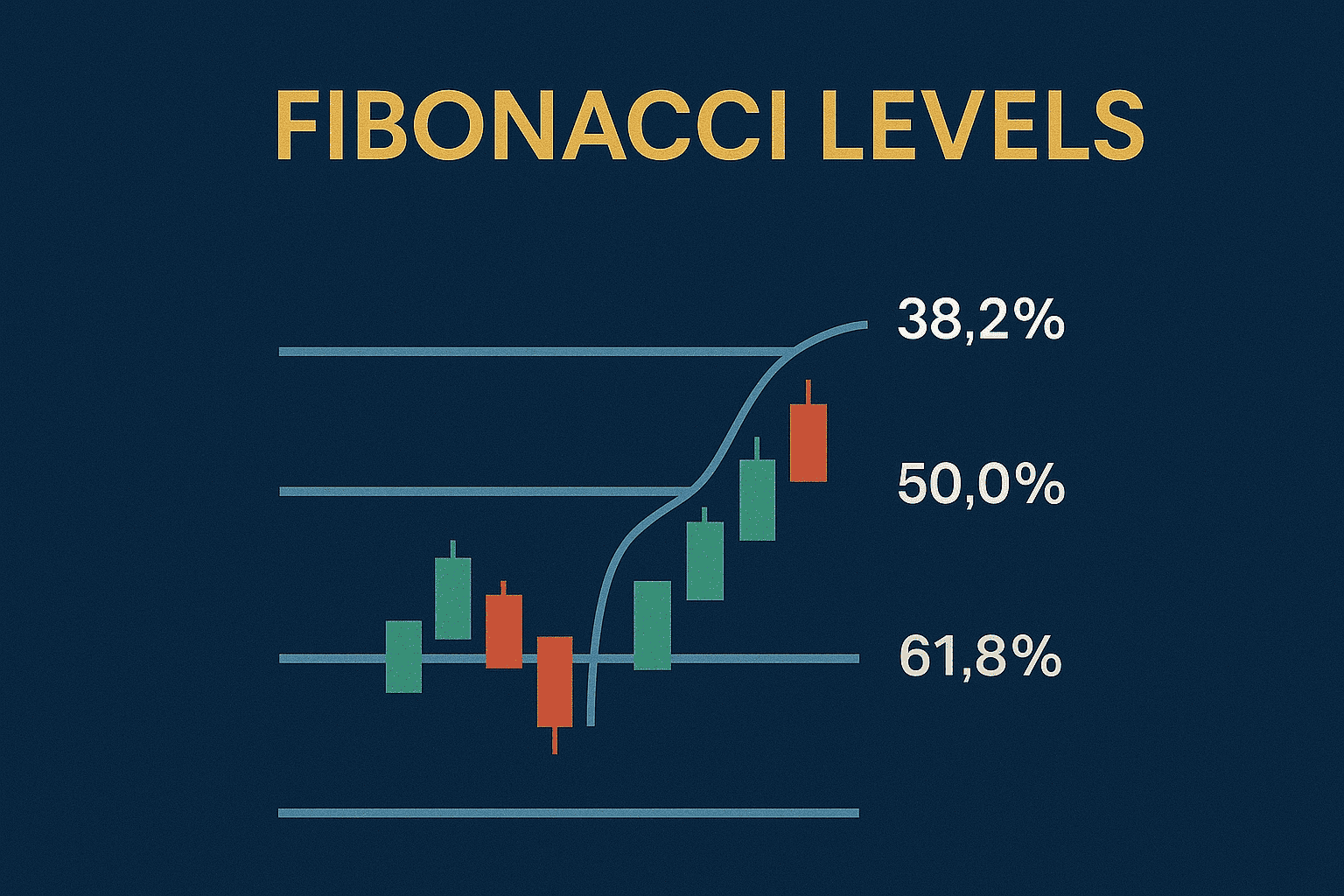

3️⃣ Fibonacci Levels

Use Fib targets (0.618, 1.618) for highly accurate TP levels.

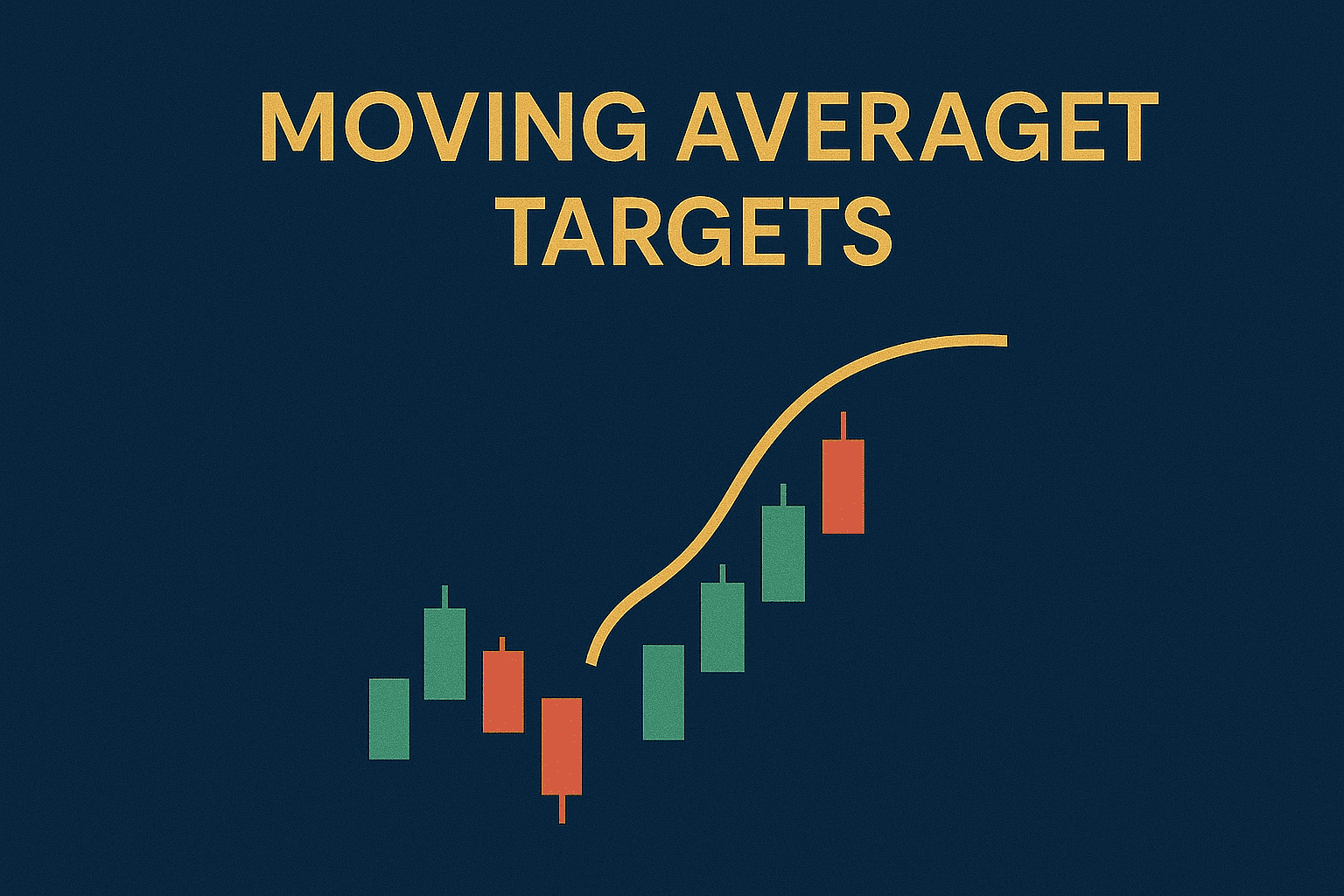

4️⃣ Moving Average Targets

When price touches or breaks major MAs like:

- 20 EMA

- 50 EMA

- 200 EMA

Good for swing trades.

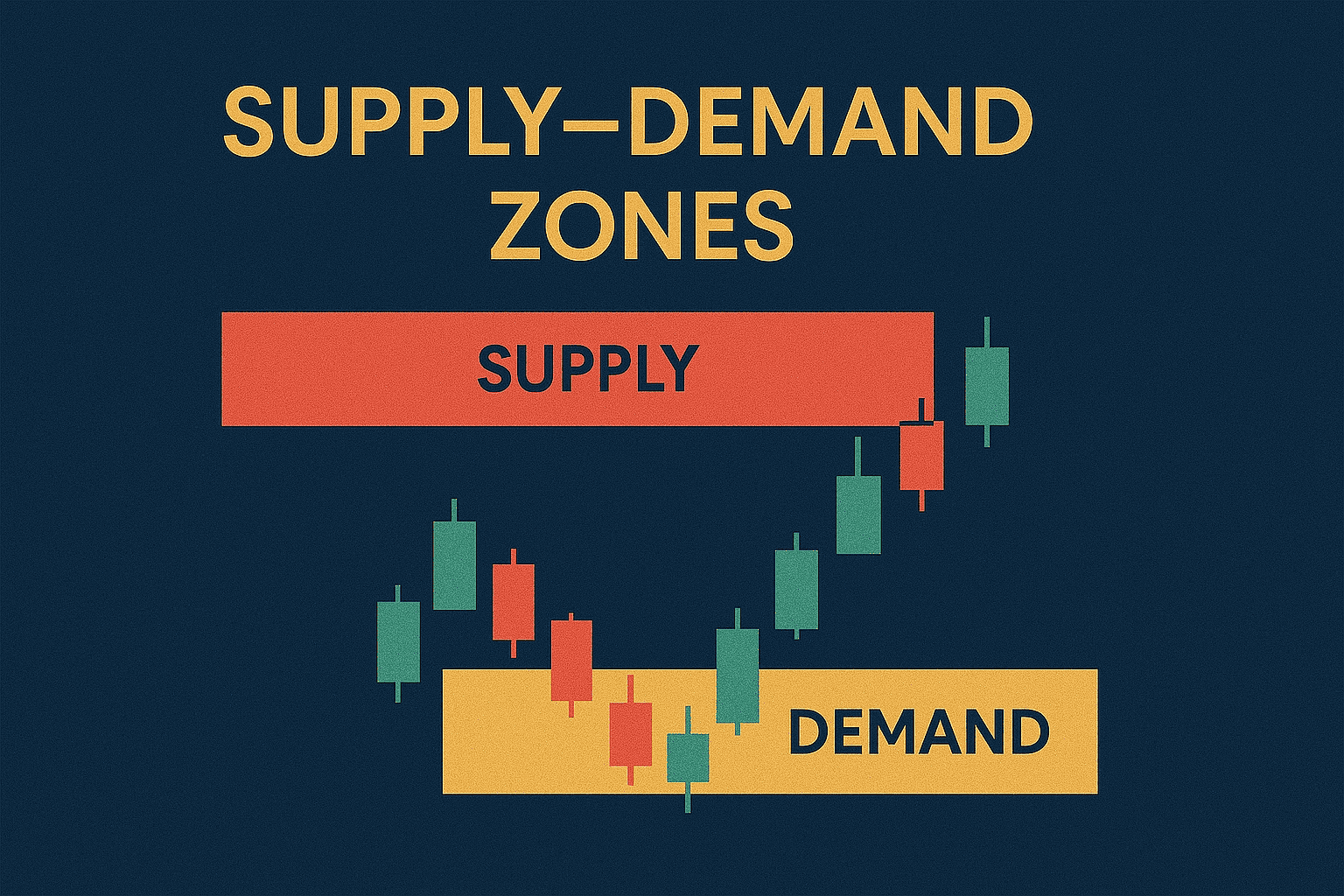

5️⃣ Supply–Demand Zones

TP at major supply zones is extremely effective.

🌟 Real Example of Stop Loss & Take Profit

Example Trade

- Stock: Reliance

- Buy Price: ₹2,500

- Support: ₹2,480

- Resistance: ₹2,540

Setting Stop Loss:

Put SL near technical support:

👉 Stop Loss = ₹2,475

Setting Take Profit:

Based on resistance:

👉 TP = ₹2,540

Risk–Reward:

- Risk: ₹2,500 – ₹2,475 = ₹25

- Reward: ₹2,540 – ₹2,500 = ₹40

RRR = 1:1.6 → Acceptable

❌ Common Mistakes Traders Make

Here are the biggest mistakes beginners make:

1️⃣ Setting SL Too Tight

Stops get hit easily and you miss big moves.

2️⃣ No RRR Strategy

Taking ₹10 profit but losing ₹50 is financial suicide.

3️⃣ Moving SL Away Out of Fear

Never do this — you turn small losses into big ones.

4️⃣ Not Booking Profit

Waiting too long ruins good trades.

5️⃣ Trading Without a Plan

Enter → Market reverses → Panic → Big loss.

This happens when SL/TP isn’t predefined.

🧠 Pro Traders’ Secrets for SL & TP

Here’s what professional traders actually do:

✔ Always Decide SL/TP Before Entering the Trade

Not after entering.

✔ Never Risk More Than 1–2% Per Trade

Anything above this is gambling.

✔ Use Trailing Stop Loss

Lock profits as price moves in your favor.

✔ Combine Technical + Volatility Levels

This creates the most accurate SL/TP zones.

✔ Journal Every Trade

Track your mistakes and improve faster.

📌 Stop Loss & Take Profit Strategies for Different Trading Styles

1️⃣ Intraday Trading

- Use tighter SL (0.3%–0.7%)

- Use ATR or candle lows

- TP usually 1:2 or 1:3

2️⃣ Swing Trading

- Wider SL based on structure

- TP on key resistance levels

- Use trailing SL for big moves

3️⃣ Breakout Trading

- SL below breakout candle

- TP at next resistance or measured move

4️⃣ Trend Following

- SL on 20/50 EMA

- TP with trailing EMA exits

📦 Conclusion: The Formula for Long-Term Trading Success

If you truly want to grow in trading, remember this:

👉 Your profits come from discipline, not predictions.

👉 Stop Loss protects your account.

👉 Take Profit protects your earnings.

A trader without SL & TP is guaranteed to blow up — it’s just a matter of time.

Master these two tools and you’ll automatically become:

- More confident

- More consistent

- More profitable

Leave a Reply