⭐ 1. Introduction — Why Diversification Matters in 2025

The financial world in 2025 is more dynamic than ever. With changing interest rates, fast economic shifts, geopolitical tensions, inflation cycles, and rapidly growing digital assets — investors cannot rely on one single asset class.

That’s why diversification is your strongest weapon.

A diversified investment portfolio helps you:

- Reduce risk

- Increase stable returns

- Protect wealth during market crashes

- Capture growth from multiple sectors

- Build long-term financial security

This guide will show you exactly how to build a perfectly diversified portfolio in 2025, step-by-step.

⭐ 2. What Exactly Is a Diversified Portfolio?

A diversified portfolio simply means:

👉 Your money is spread across many different types of investments

👉 So that your risk doesn’t depend on a single asset

Example:

If your entire money is in stocks and the market crashes, you lose big.

But if you have stocks + gold + bonds + real estate + ETFs, your portfolio stays stable.

Diversification is about balance + safety + growth.

⭐ 3. The Ideal Portfolio Structure for 2025

In 2025, analysts recommend building a portfolio that includes:

● 40–50%: Equity (Stocks / Equity Mutual Funds / ETFs)

For long-term wealth creation.

● 15–20%: Fixed Income (Bonds, Debt Funds, Treasury Bills)

For stability and safety.

● 10–15%: Gold & Precious Metals (Digital Gold, Gold ETF)

For inflation protection.

● 10–15%: Real Estate / REITs

For passive rental-like income.

● 5–10%: High-Growth Assets (AI Stocks, Tech ETFs, Crypto in regulated countries)

For future innovation exposure.

This formula works for beginners and experts both.

⭐ 4. Step-by-Step Guide: How to Build a Diversified Portfolio in 2025

🔹 Step 1: Define Your Financial Goals

Ask yourself:

✔ Are you building wealth for retirement?

✔ Buying a home?

✔ Planning kids’ education?

✔ Short-term goals in 1–3 years?

✔ Long-term goals in 7–20 years?

Your goals determine how aggressive or safe your portfolio should be.

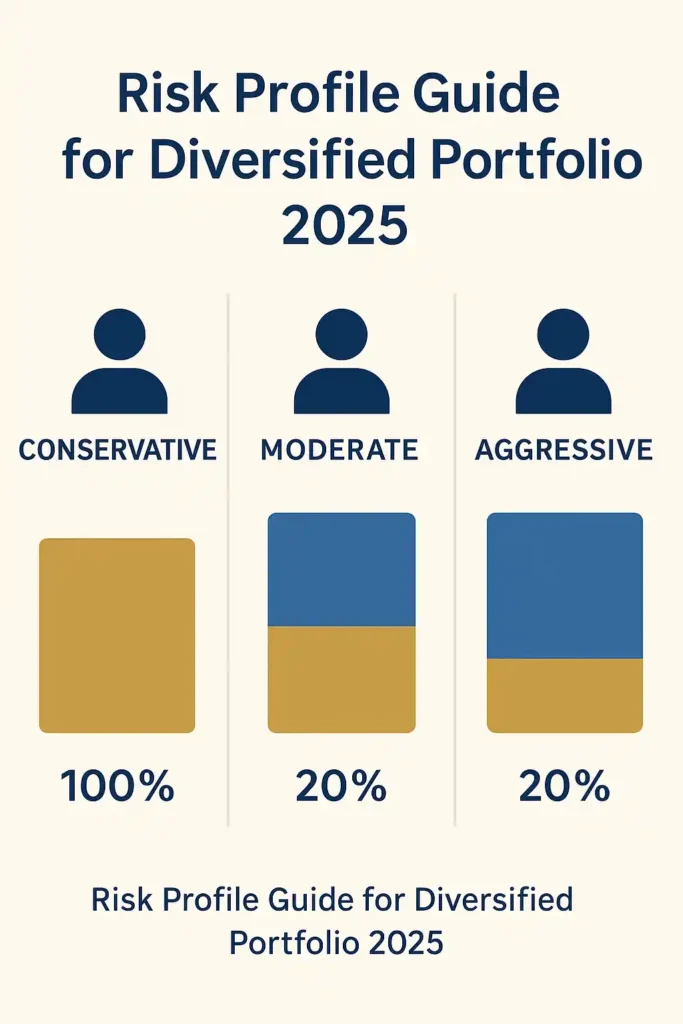

🔹 Step 2: Calculate Your Risk Profile

There are 3 types of investors:

1. Conservative

Low risk, want safety

→ More bonds + less stocks

2. Moderate

Balanced risk

→ Mix of stocks + bonds + gold

3. Aggressive

Comfortable with volatility

→ More stocks + global ETFs + growth assets

Know yourself before you invest.

🔹 Step 3: Build Your Equity Section (40–50%)

Equity gives long-term returns between 10–15% annually.

Best options for 2025:

- Large Cap Mutual Funds

- Nifty 50 Index Funds

- S&P 500 ETFs (International diversification)

- Blue-chip stocks

- High-quality mid-cap funds

Safe allocation example:

- 20% Large Cap

- 10% Mid Cap

- 10% International ETF

- 5% Sectoral Themes (EV, AI, Green Energy)

🔹 Step 4: Build Your Fixed Income Section (15–20%)

This part protects your portfolio during market crashes.

Best options:

- Government Bonds

- Bharat Bond ETF

- Liquid Funds

- Corporate Bond Funds

- Treasury Bills

Fixed income gives stable 6–8% returns with low risk.

🔹 Step 5: Add Gold (10–15%)

Gold works best during:

- Inflation

- Recession

- War

- Market crash

Best options in 2025:

- Gold ETF

- Digital Gold

- Sovereign Gold Bonds (SGBs)

SGBs give extra 2.5% interest + tax-free maturity, making them the top choice.

🔹 Step 6: Include Real Estate or REITs (10–15%)

You don’t need to buy a physical property.

REITs are better because:

- Low investment (₹300–₹500 per unit)

- Monthly/quarterly payouts

- No maintenance cost

- No property tax

- Easy to sell

REITs in 2025:

- Mindspace

- Embassy

- Brookfield

🔹 Step 7: High-Growth Assets (5–10%)

This is optional but powerful.

2025’s Top Growth Themes:

- Artificial Intelligence (AI ETFs)

- Electric Vehicles (EV ETFs)

- Semiconductor Funds

- Global Tech ETFs

- Regulated crypto in legal countries

Only invest a small portion, not your whole portfolio.

⭐ 5. Sample Diversified Portfolio for 2025 (Beginner-Friendly)

Conservative Investor

- 30% Large Cap Index Fund

- 25% Bonds

- 20% Gold/SGB

- 15% REITs

- 10% FD/Liquid Funds

Moderate Investor

- 40% Equity (Large + Mid Cap)

- 20% Bonds

- 15% Gold

- 15% REITs

- 10% Global Tech ETFs

Aggressive Investor

- 55% Equity

- 10% Global ETFs

- 10% Gold

- 10% REITs

- 10% Growth Themes

- 5% Bonds

⭐ 6. Tips to Maintain a Diversified Portfolio in 2025

✔ Rebalance every 6 months

✔ Don’t panic during market dips

✔ Use SIP for steady investing

✔ Avoid over-diversification

✔ Track performance once a month

✔ Invest for minimum 5–10 years

⭐ 7. Common Mistakes to Avoid

❌ Putting all money in stocks

❌ Chasing quick profits

❌ Investing without goals

❌ Buying too many funds

❌ Ignoring rebalancing

❌ Buying hyped assets without research

⭐ 8. Conclusion — 2025 Is the Best Time to Build a Smart, Diversified Portfolio

A perfectly diversified portfolio protects you, grows your wealth, reduces stress, and builds long-term financial freedom.

2025 offers more options than ever — stocks, global ETFs, gold, bonds, REITs, AI-based assets — and combining them smartly can help you create lifelong prosperity.

Invest smart. Invest diversified.

Your future self will thank you.

Leave a Reply