Most people think wealth is created by choosing the “best stocks” or chasing the “highest returns.”

But the truth is simple:

The real wealth multiplier is time — powered by compounding.

Compounding is often called the 8th wonder of the world, and for a good reason. It can turn small investments into massive wealth when you give it enough time. In long-term investing, compounding is the force that lets your money grow automatically, even while you sleep.

In this article, you’ll understand what compounding really is, how it works, why it benefits long-term investors the most, and how you can use it to build life-changing wealth.

What Is Compounding?

Compounding means:

Your money earns returns → those returns also start earning returns → and the cycle continues.

In simple words:

Your money works for you.

Then the money earned by your money also starts working for you.

This creates a snowball effect that becomes incredibly powerful over time.

How Compounding Works (Simple Example)

Let’s say you invest ₹10,000 at 10% annual return:

Year 1: ₹10,000 → ₹11,000

(You earned ₹1,000)

Year 2: ₹11,000 → ₹12,100

(You earned ₹1,100 — more than last year!)

Year 5: ₹10,000 → ~₹16,100

Year 10: ₹10,000 → ~₹26,000

Year 20: ₹10,000 → ~₹67,000

Year 30: ₹10,000 → ~₹1,74,000

You did nothing extra — but the money kept growing.

That is the power of compounding.

Why Compounding Works Best for Long-Term Investing

1. Time Amplifies Growth

The longer your money stays invested, the more it accelerates.

The biggest growth happens in the last few years — not the early ones.

2. Small Contributions Become Big

Even small SIP amounts like ₹500–₹1000 monthly can become lakhs or crores over long periods.

3. Reduces Market Volatility Risk

Long-term investors benefit from recoveries, corrections, and market cycles.

4. Helps Build Wealth Without Stress

Compounding rewards patience, consistency, and discipline — not frequent trading.

Compounding Formula (For Clarity)

Compounding works through this formula:

A = P (1 + r)^n

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual return rate

- n = Number of years

You don’t need to memorize it — but it helps you understand why time is the most powerful factor.

Why Most People Miss Out on Compounding

Many investors fail to take advantage of compounding because they:

❌ Withdraw too early

❌ Try to time the market

❌ Don’t invest consistently

❌ Panic during market corrections

❌ Prefer quick returns over long-term growth

Compounding rewards the patient — not the impatient.

How to Use Compounding to Build Massive Wealth

1. Start Investing Early

Even a 5-year head start makes a HUGE difference.

- Start at 25 → retire rich

- Start at 35 → wealth reduces drastically

- Start at 45 → missed compounding window

2. Invest Consistently (SIP Method)

Monthly SIPs accelerate compounding by adding fresh fuel to the fire.

3. Reinvest Your Profits

Don’t withdraw gains — let them grow automatically.

4. Stay Invested Long Term

Your money needs years, not days, to compound properly.

5. Avoid Panic Selling

Short-term falls don’t matter.

Long-term investors always win through compounding.

6. Let Dividends Reinvest

Dividend reinvestment adds another layer of exponential growth.

How Compounding Creates Millionaires (Realistic Example)

Let’s say you invest:

₹5,000 per month for 25 years at 12% return

Your total investment:

➡️ ₹15 lakh

Final amount through compounding:

➡️ ₹85+ lakh

You did nothing extra — compounding did all the heavy lifting.

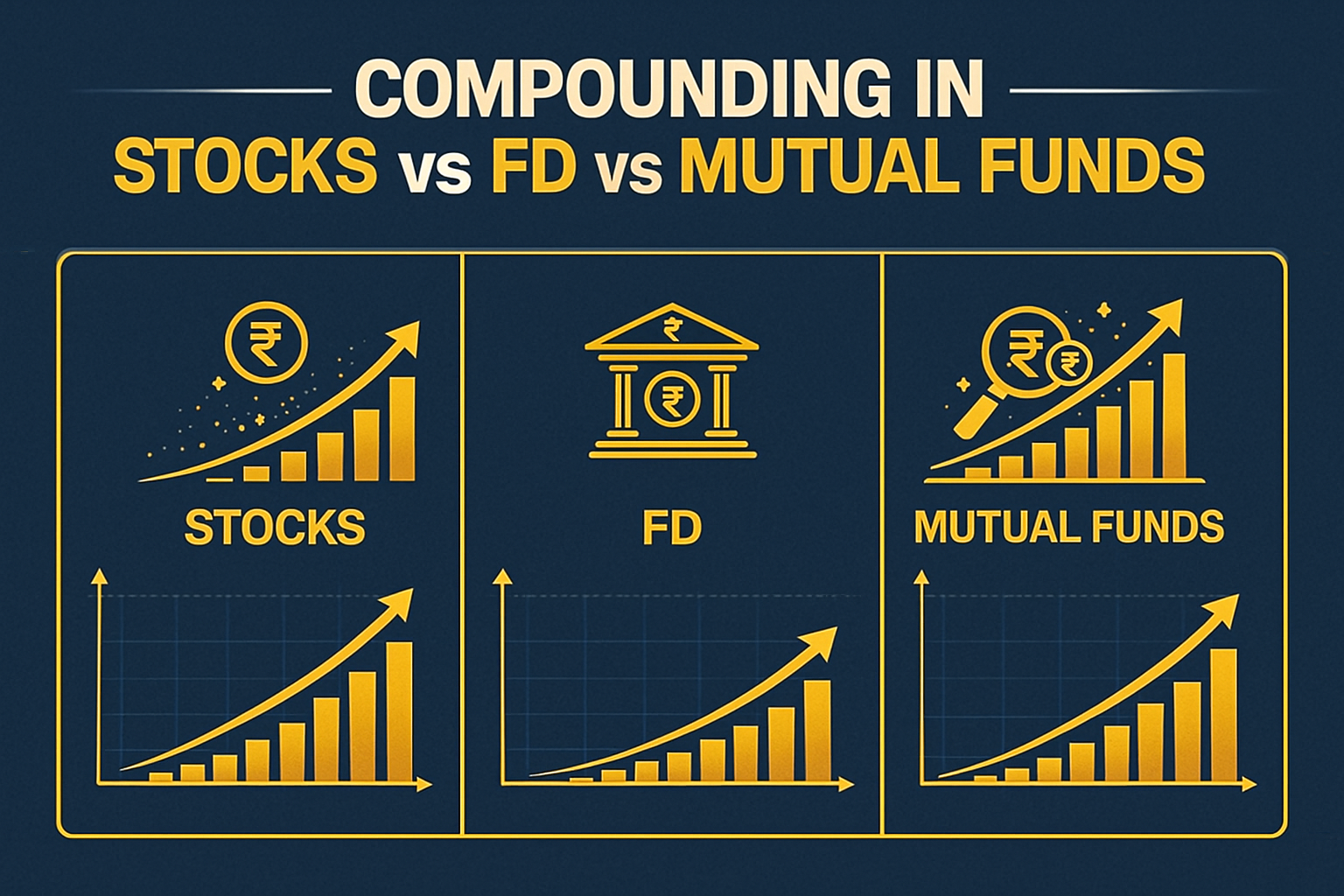

Compounding in Stocks vs FD vs Mutual Funds

| Investment Type | Typical Return | Compounding Strength |

|---|---|---|

| FDs | 5–6% | Low |

| Mutual Funds (Equity) | 10–14% | Strong |

| Stocks (Good Companies) | 12–20%+ | Very strong |

| Index Funds | 10–12% | Stable & strong |

Stocks and equity mutual funds are the best compounding machines for long-term wealth creation.

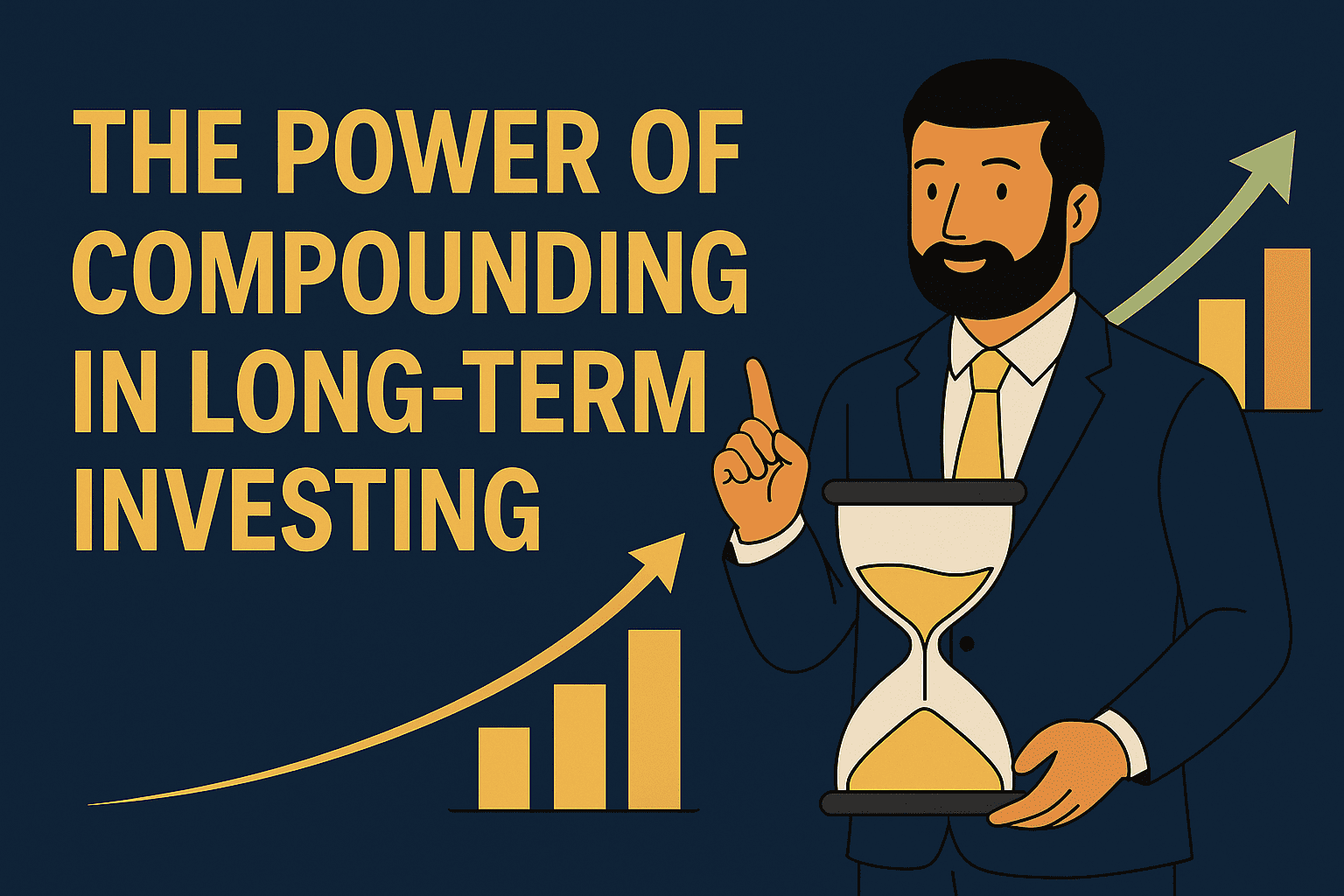

The Compounding Curve: Slow… then FAST

Compounding always feels slow in the beginning.

For the first 5–10 years:

➡️ Growth feels small

➡️ Returns look boring

➡️ You feel like nothing is happening

But after 12–15 years:

➡️ Wealth suddenly accelerates

➡️ Numbers explode

➡️ Growth becomes exponential

This final phase is where millionaires are created.

Mistakes That Can Destroy Compounding

❌ Frequently withdrawing money

❌ Changing investments too often

❌ Chasing high returns

❌ Not investing consistently

❌ Starting too late

❌ Panic selling during crashes

Avoid these and compounding will reward you heavily.

Conclusion

Compounding is the most powerful tool for building long-term wealth.

When combined with:

✔️ Regular investing

✔️ Discipline

✔️ Patience

✔️ Long horizon

… it can turn even small, consistent investments into life-changing wealth.

The earlier you start, the bigger the result.

The longer you stay invested, the faster your wealth grows.

**Don’t wait for the “right time.”

Time itself is your biggest wealth creator.**

Leave a Reply